Why subscribe?

Every week, I will be sharing an in-depth look into my routine managing my personal investment portfolio, including my risk model, stock screens and watchlists. I aim to consistently impart the discipline, structure, systematic approach, and essential elements crucial for consistently outperforming the market.

TraderFella Investment Strategy

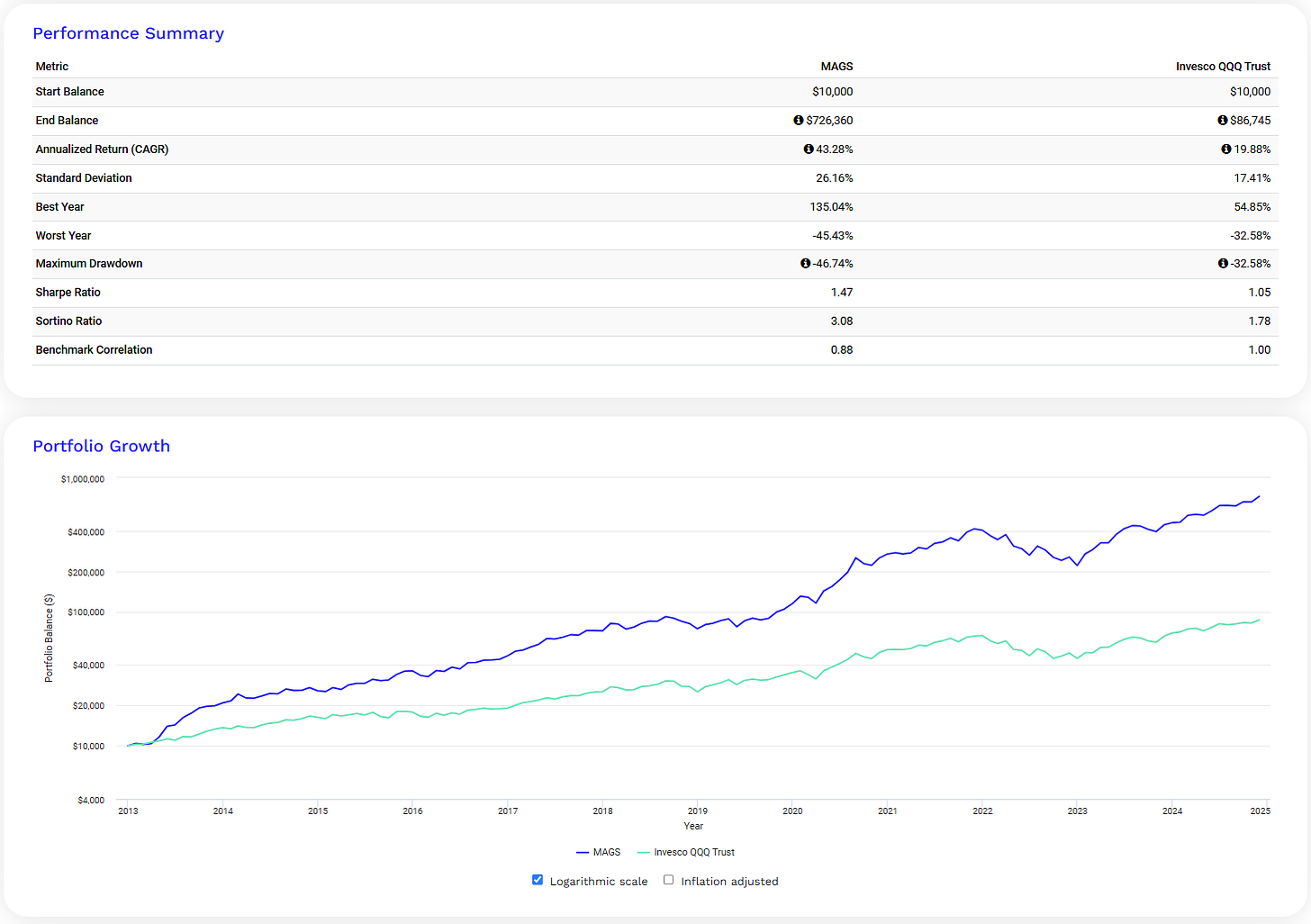

Plain and simple, my goal is to beat the benchmark returns of the QQQ.

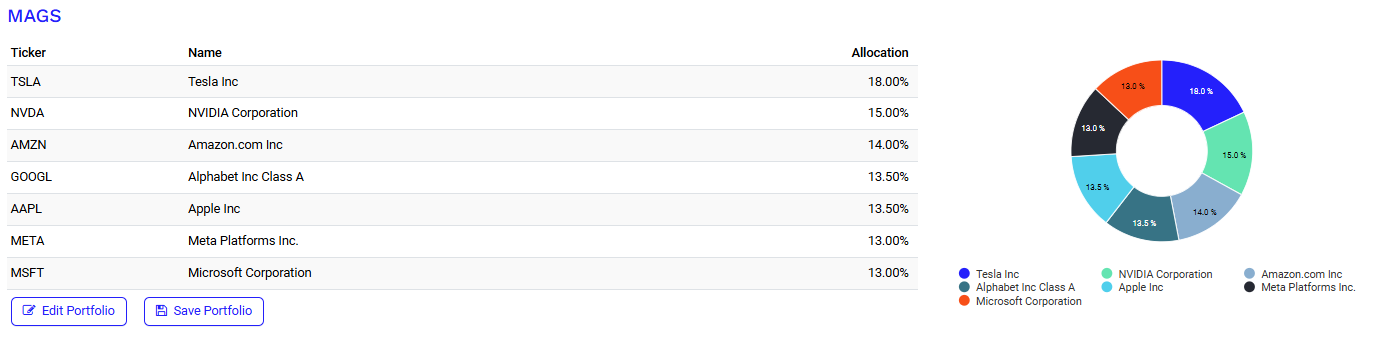

Of the ~100 positions in the QQQ, ~50% of the holdings are in the top 10 names. The majority of the other 90 names are those you wouldn’t necessarily identify as growth stocks or may have undesirable weighting. Of these top 10 holdings, you will quickly recognize the FAANG names or more recently the Magnificent Seven (MAGS). In comparing the performance of MAGS to the QQQ as a benchmark below, these names have significantly outperformed the QQQ over the same period (Jan 2013 to Nov 2024 - rebalanced quarterly).

This inspired me to create my own portfolio with a goal to outperform the QQQ.

Portfolio Guidelines

Market Timing Risk Model

Designed to reduce exposure in major downtrends and participate in major uptrends.

~50% allocation to FAANG/MAGS or alike mega cap names

Quantitative, fundamental and technical stock selection

30 positions max

Statistics show that owning just eight stocks eliminates 81% of the nonmarket risk of owning just one stock. This type of risk is reduced by 93% with 16 stocks, 96% with 32 stocks, and 99% with 500 stocks. The marginal benefit of diversification quickly falls as you add incremental stocks to your portfolio.

Disclaimer

This information is provided for general informational purposes only and does not constitute financial advice. Investing involves risk, and past performance is not indicative of future results. Before making any investment decisions, you should carefully consider your individual circumstances and consult with a qualified financial advisor.

I don’t provide personal investment advice, Q&A, consultations, coaching, recommendations, etc. on Substack.com. I only share my own thoughts and observations regarding the market and stocks/trades I’m in or thinking about for my own account.

Stay up-to-date

You won’t have to worry about missing anything. Every new edition of the newsletter goes directly to your inbox.