Week 18 - FTD & Zweig Breath Thrust

Welcome to TF Weekly, please consider taking a few seconds to help make these articles possible by supporting my work, which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

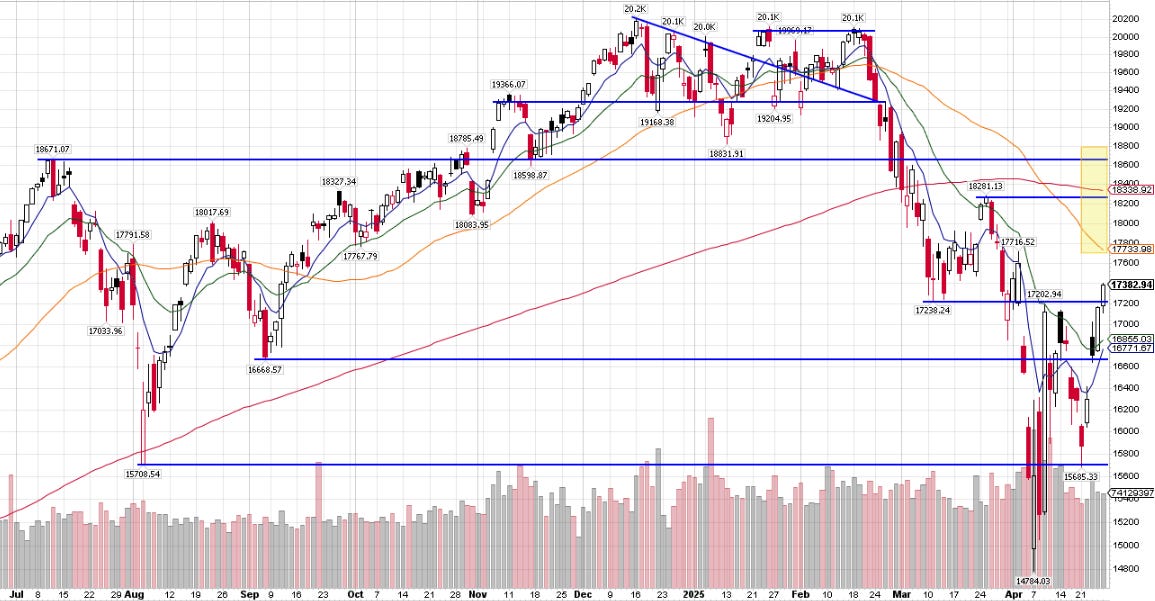

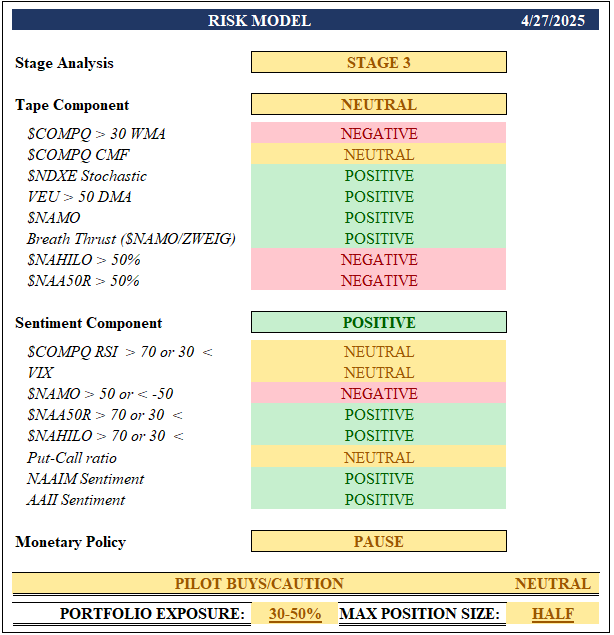

GENERAL MARKET & RISK MODEL

On April 22nd we had a Follow-Through Day (FTD) followed by a rare Zweig breath thrust on April 24th. Although this is overwhelmingly positive, taking a step back, we are coming from deeply oversold levels with record negative sentiment so a bounce was to be expected. We are still however in a downtrend below the 50 and 200 DMA with many areas of potential resistance above and little merchandise (stocks setting up) to choose from. This leads me to believe that this is a tradable bounce, but potential areas of resistance on the indexes such as the 50/200 DMA and the March highs should be watched for a potential reversal. The right side of bases need to setup so chopping and backfilling here would be constructive, but I’m not leaving out the possibility for a 3rd wave lower. Although the Zweig breath thrust has a perfect track record for positive return 6 to 12 months out, it is important to note it is not a bottoming indicator (perfect for getting you chopped up).

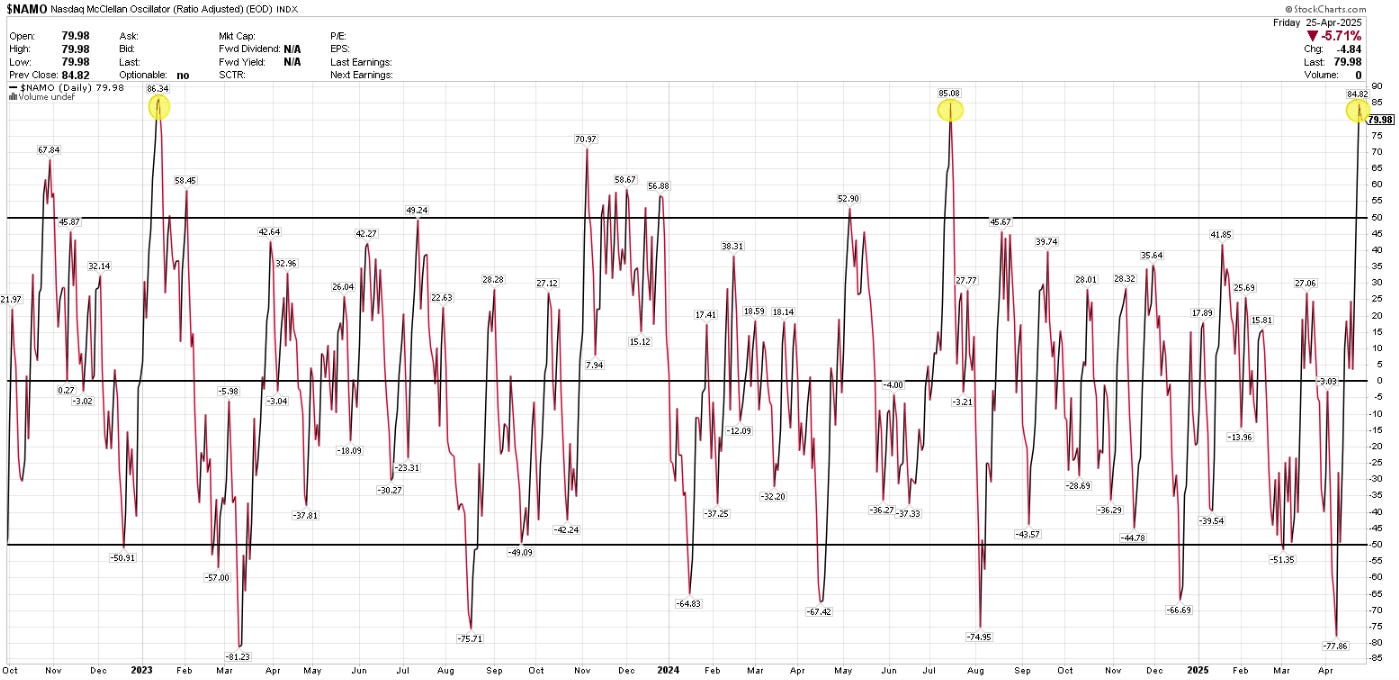

$NAMO

Also important to note that the McClellan oscillator is very overbought. The most recent readings near +85 occurred below, which also supports a pullback (regardless of market direction thereafter).

July 2024 - ~16% correction on $QQQ, prior to stage 3 distribution

January 2023 - ~9% correction on $QQQ, prior to stage 2 uptrend

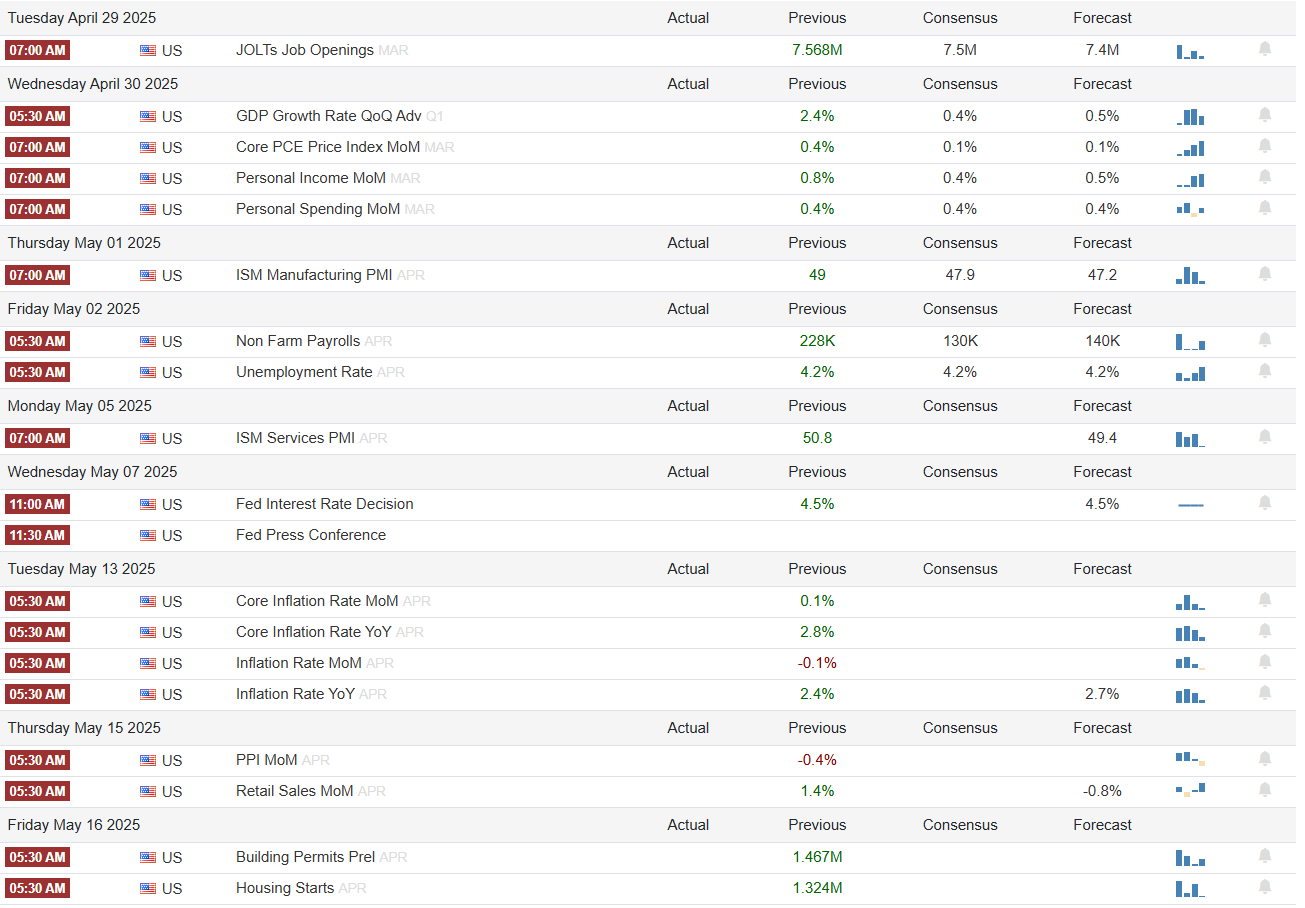

Economic Calendar

Earnings

Game Plan

Update from Week 17

I was highly anticipating a bounce from a very oversold condition with such bearish sentiment. Once the FTD was confirmed on April 22nd followed by TSLA earnings that Tuesday evening, I noticed an important change of character after a dismal earnings report, the stock actually rallied after hours. When bad news starts to get faded, especially in corrections/bear markets, its often bullish as stocks have already discounted that news. Going into Wednesday, I was pretty aggressive in getting invested and became fully invested by Thursday. My main focus list was NFLX PLTR CRWD SPOT. However, I didn’t like how SPOT was acting, especially before earnings, so I kicked that name out for a small gain. I also trimmed some of my positions on Friday after great moves, taking profits to finance overnight risk, especially with potential headline volatility over the weekend. As of Week 17, my portfolio was evenly concentrated in NFLX PLTR CRWD.

Week 18

In anticipation of a pullback in the coming days/weeks, I will be watching key areas of potential resistance 50/200 DMA or March highs on the indexes for any signs of a reversal at which point I plan to take profits and raise some cash for new setups that may emerge. If we consolidate and backfill here, it could be choppy but constructive and I would like to see a lot more names setting up then just the handful we had coming out of the FTD (which has me unsure if the bottom is truly in). If more stocks setup on a pullback, I will deploy my cash. If we gap up and run, I will be well positioned but again cautious for any signs of exhaustion to take profits in such a quick move.

Portfolio

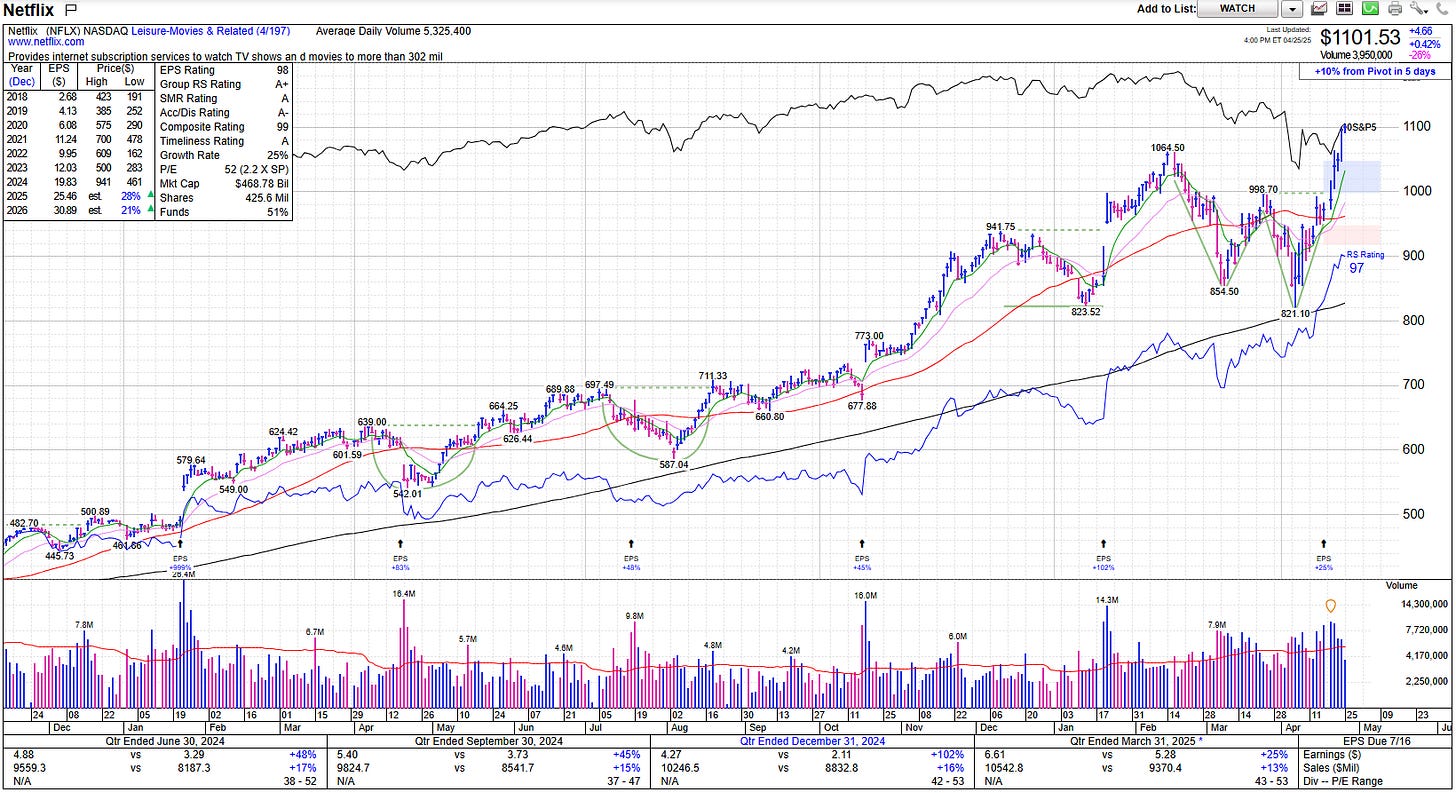

NFLX

NFLX first stock to breakout into new all time highs after earnings. I’m sure MAG7 wish they included this name lol. Will watch QQQ for clues of a reversal but so far leading.

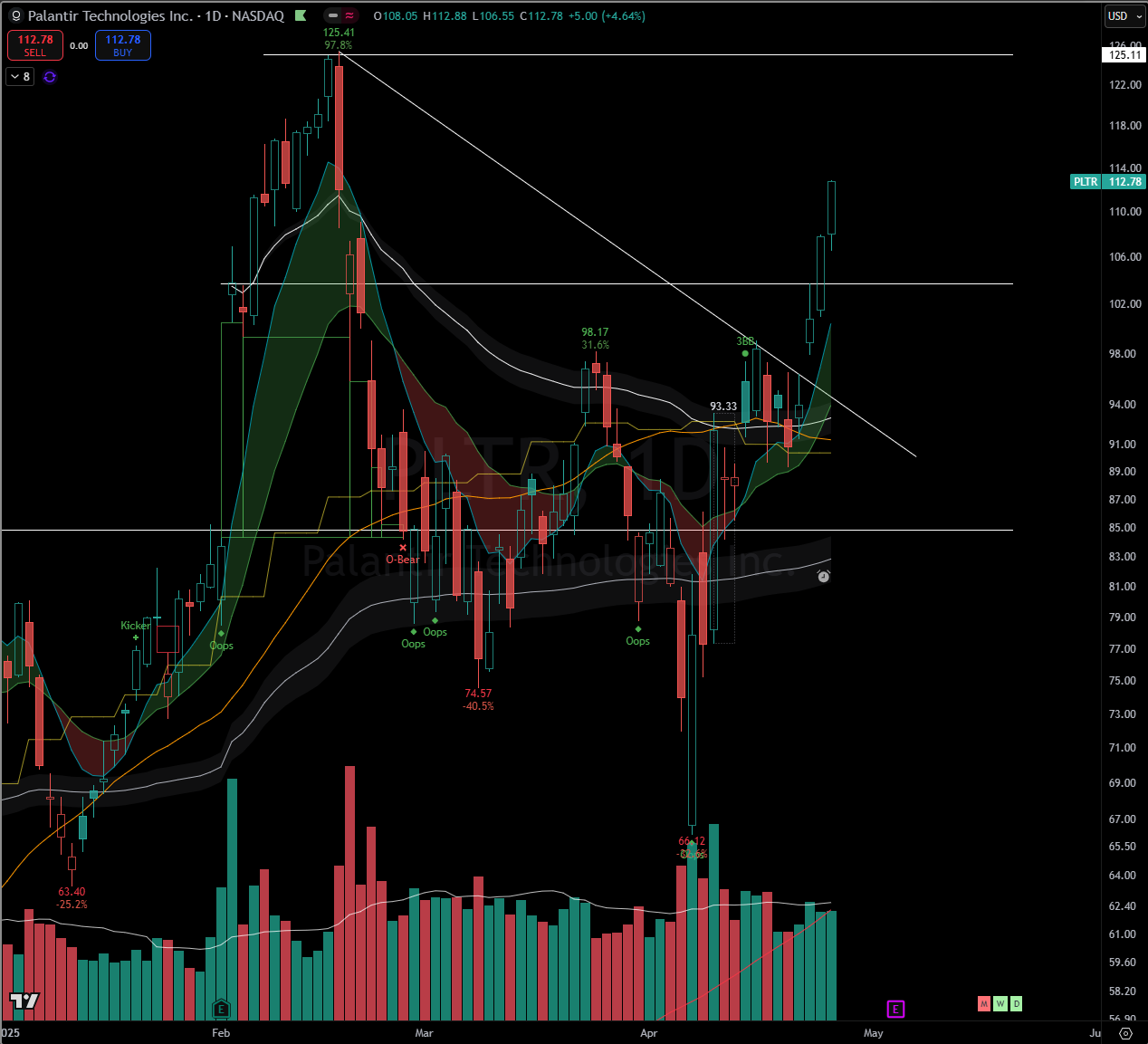

PLTR

PLTR really nice breakout, watching all time high level of ~$125 for potential resistance. Earnings Monday May 5th.

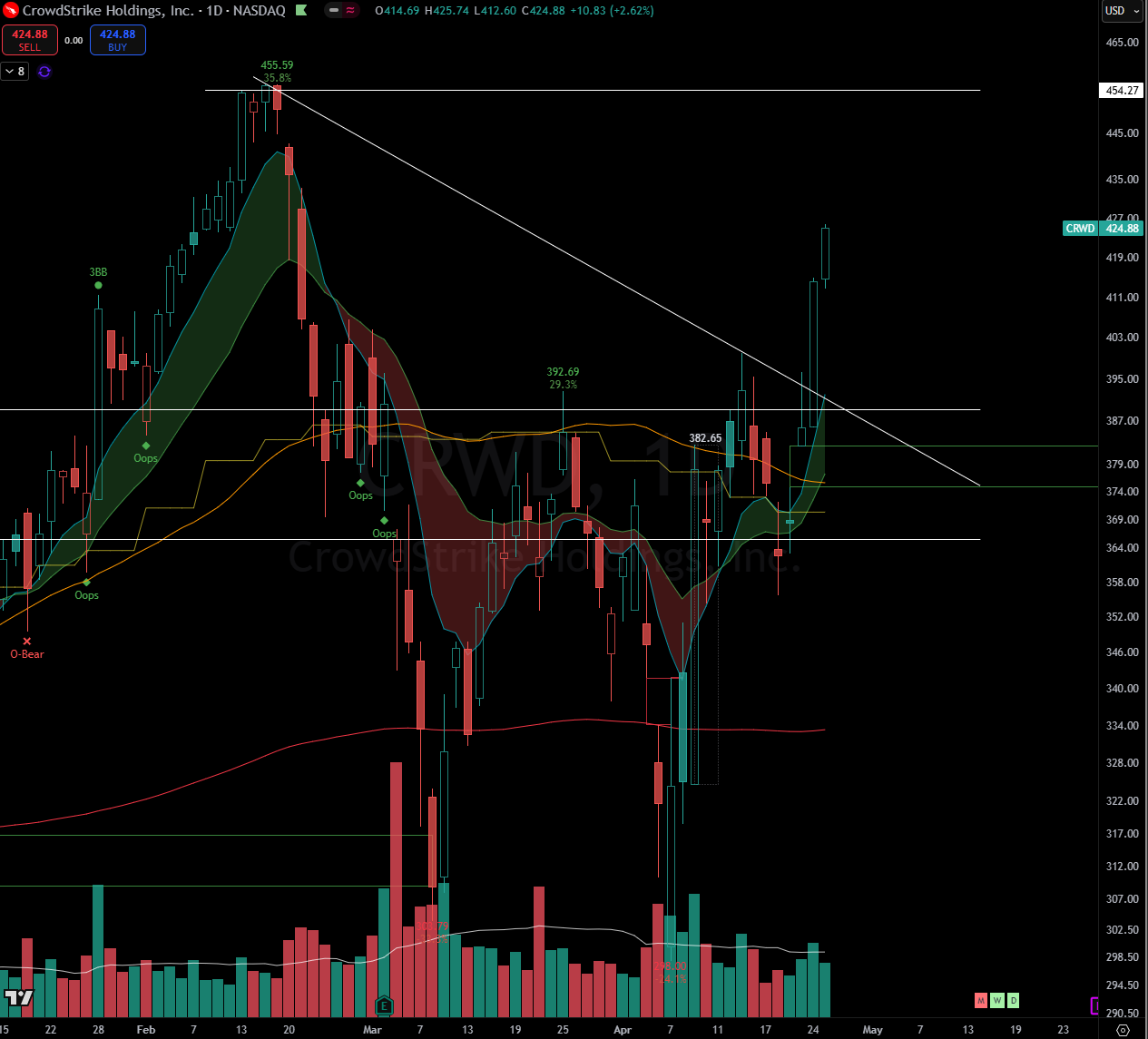

CRWD

Similar move to PLTR, watching all time high level of ~$454 for potential resistance.

Focus List

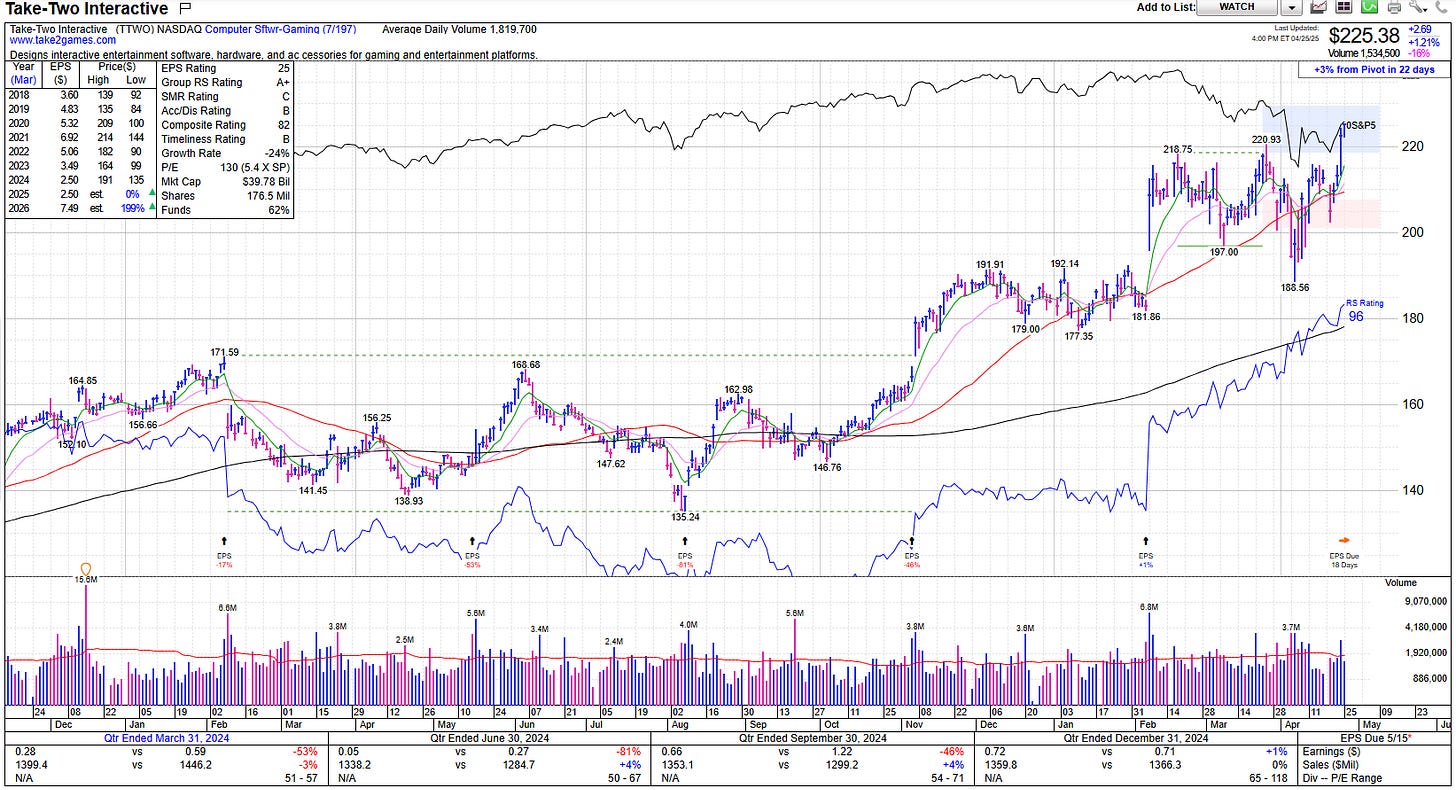

TTWO - #1 Idea

TTWO was a name I was also watching but I took SPOT instead… with TTWO having such a nice breakout into new all time highs its now my number 1 idea on a pullback (if it allows).

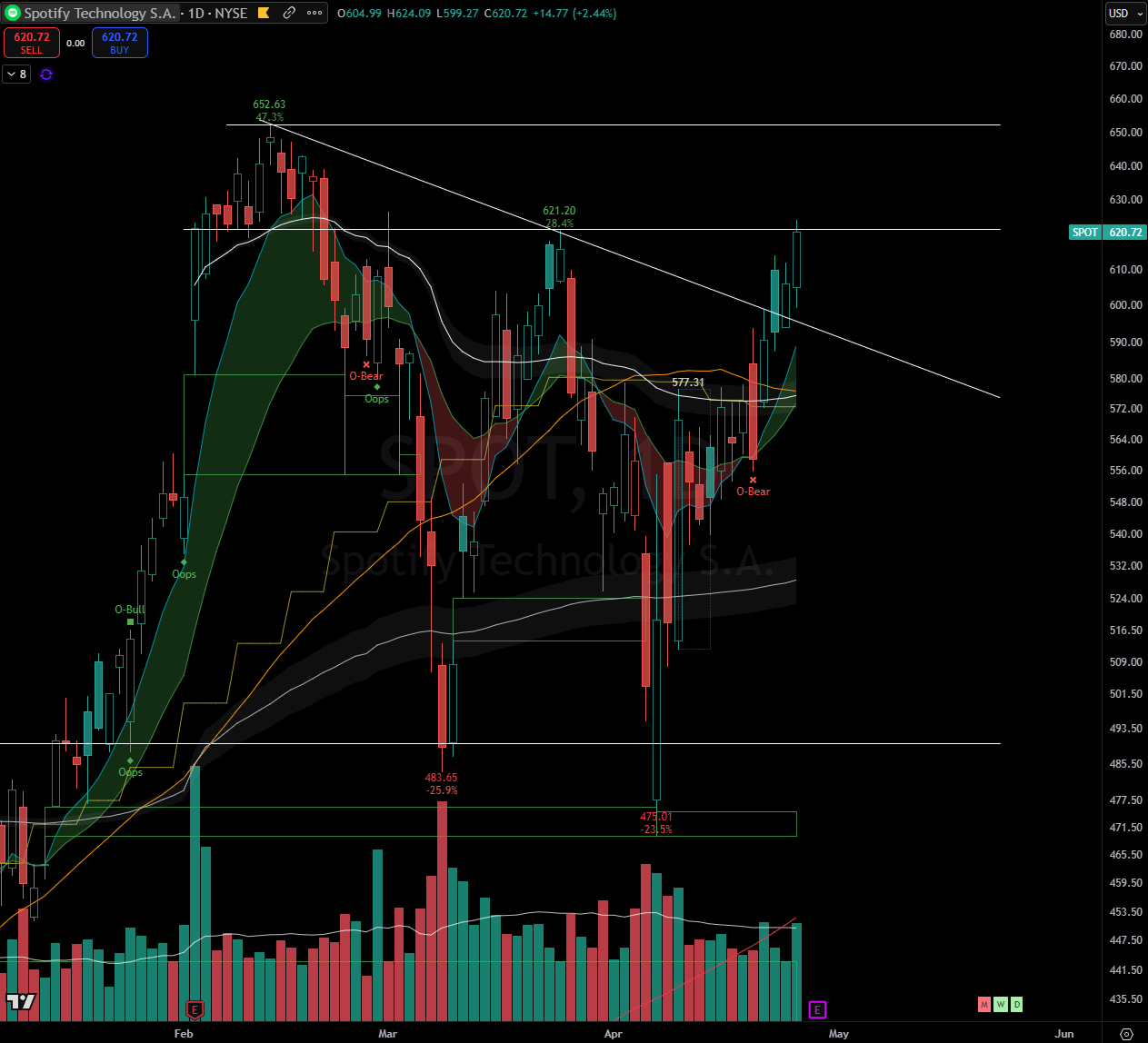

SPOT

SPOT still looks good and constructive. What I did not like was the day after the FTD it didn’t hold its gap up and closed near the low of the day (no cushion to hold overnight). The following day it was unable to take out the previous days high but an inside day nonetheless. Nice action on Friday but closed below the HVC from its last earnings report. Earnings also out on Tuesday so would not be able to get enough cushion to hold through earnings. Watching to see reaction to earnings.

IBIT

Bitcoin broke out the day before the FTD and I just wasn’t in the mindset for new buys and so I just watched this one. After the FTD, as it had already broken out, IBIT didn’t really give me a low risk spot where I could get long. Will watch to see if it sets up again.

Watchlist

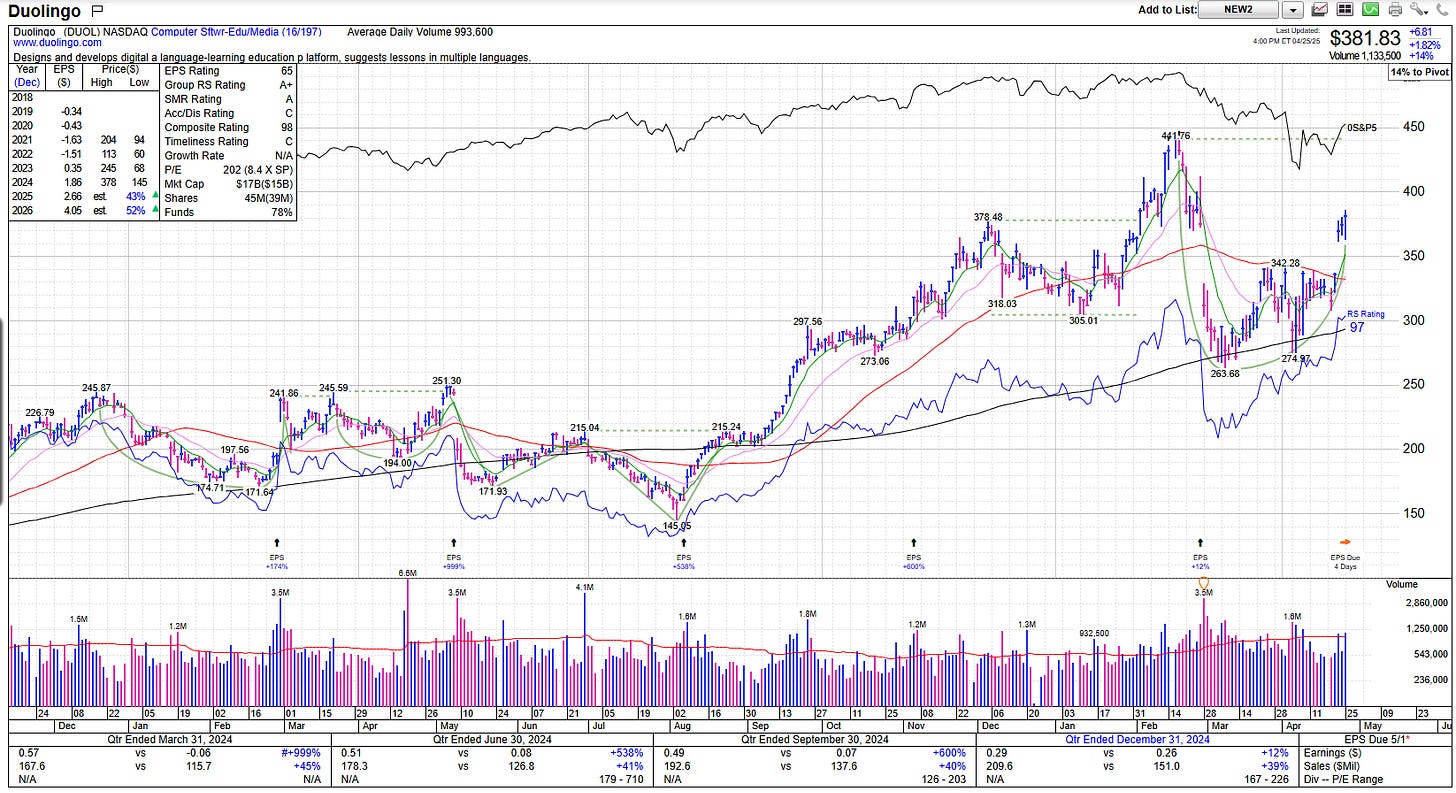

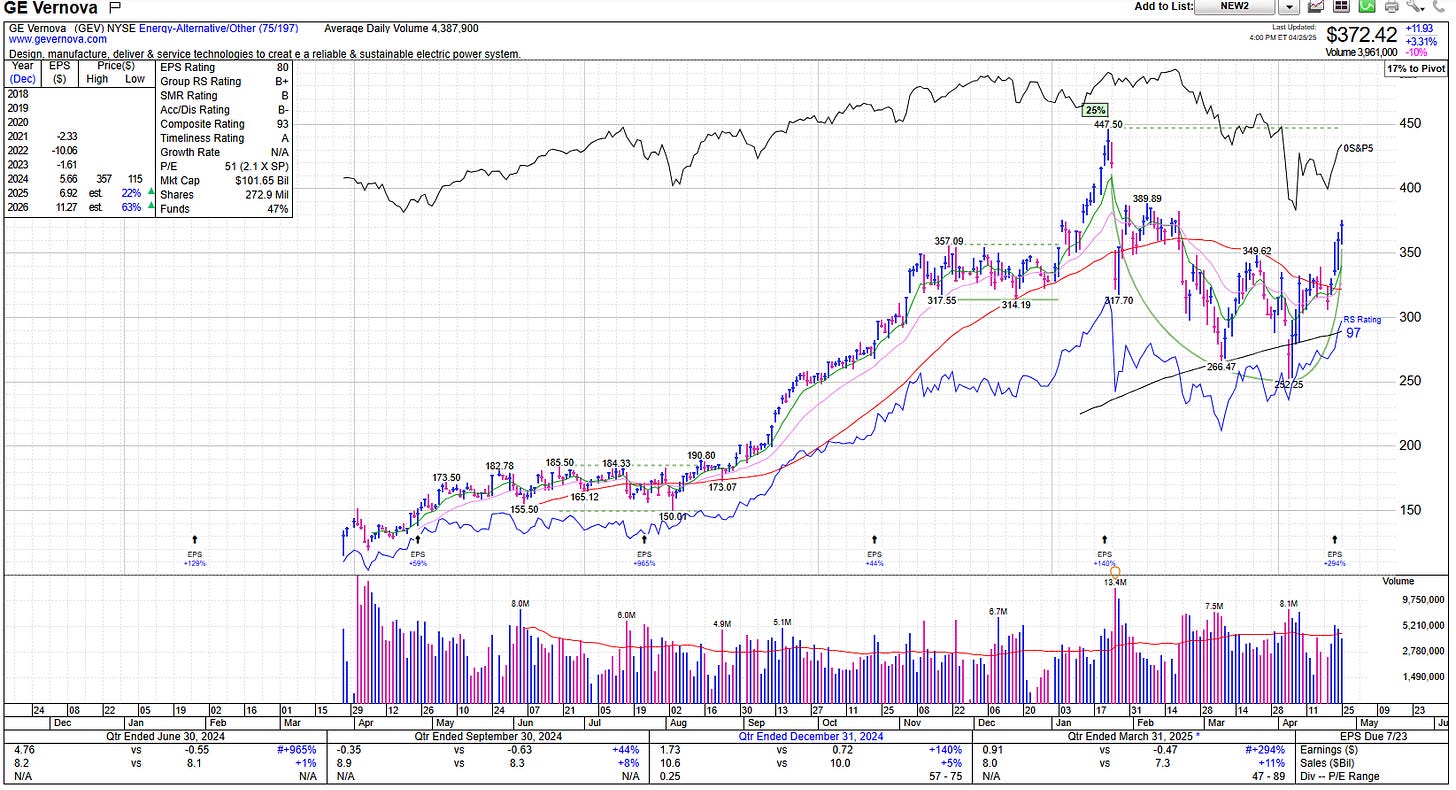

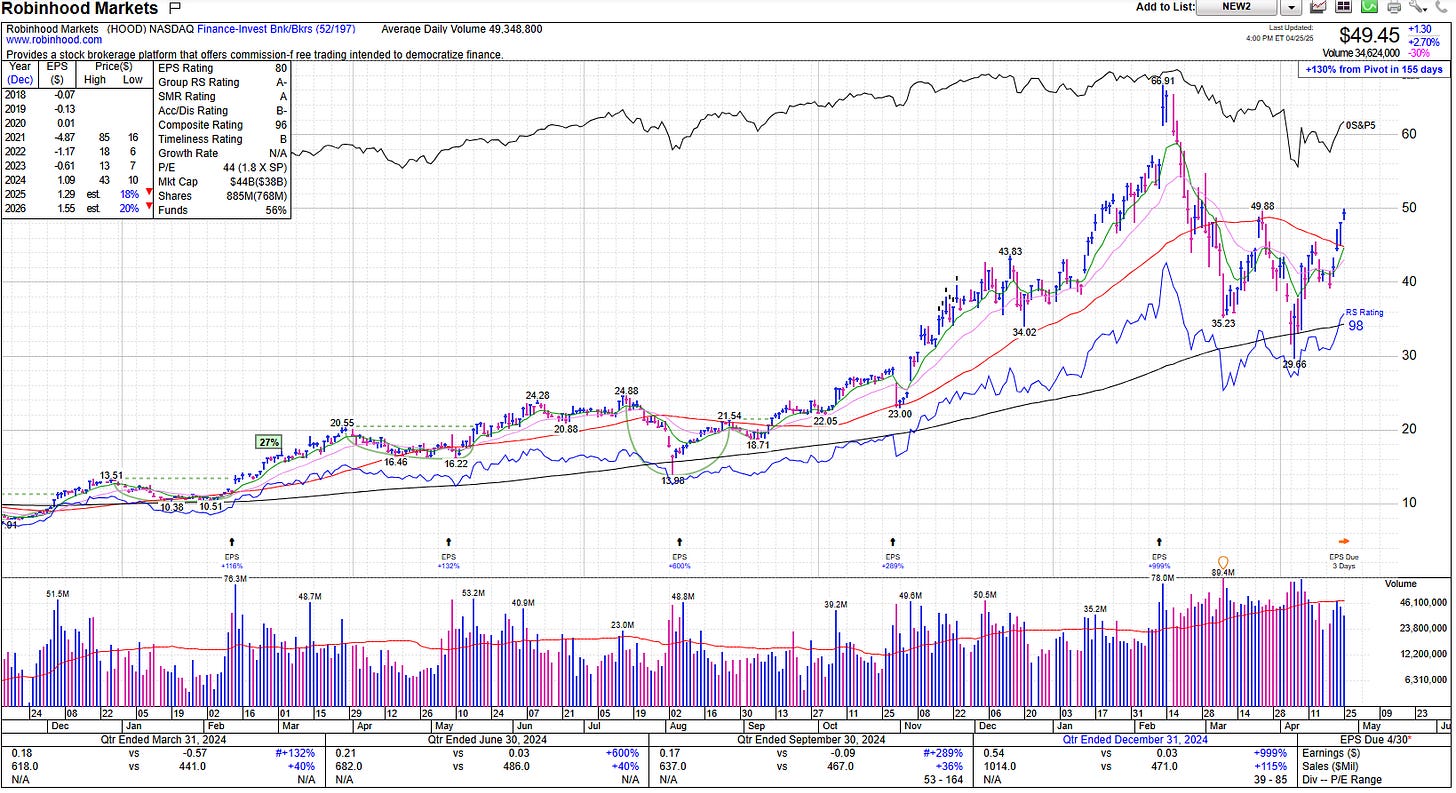

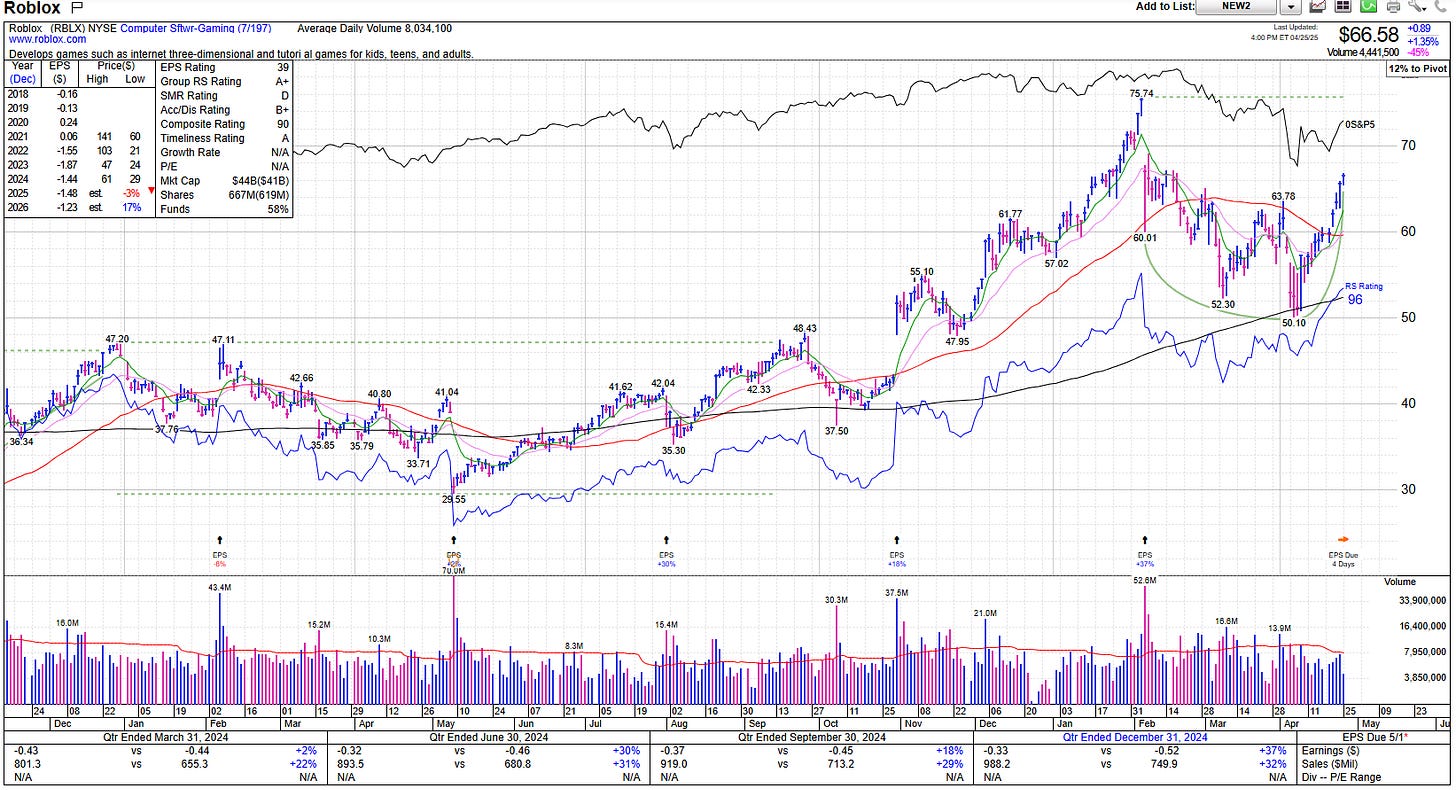

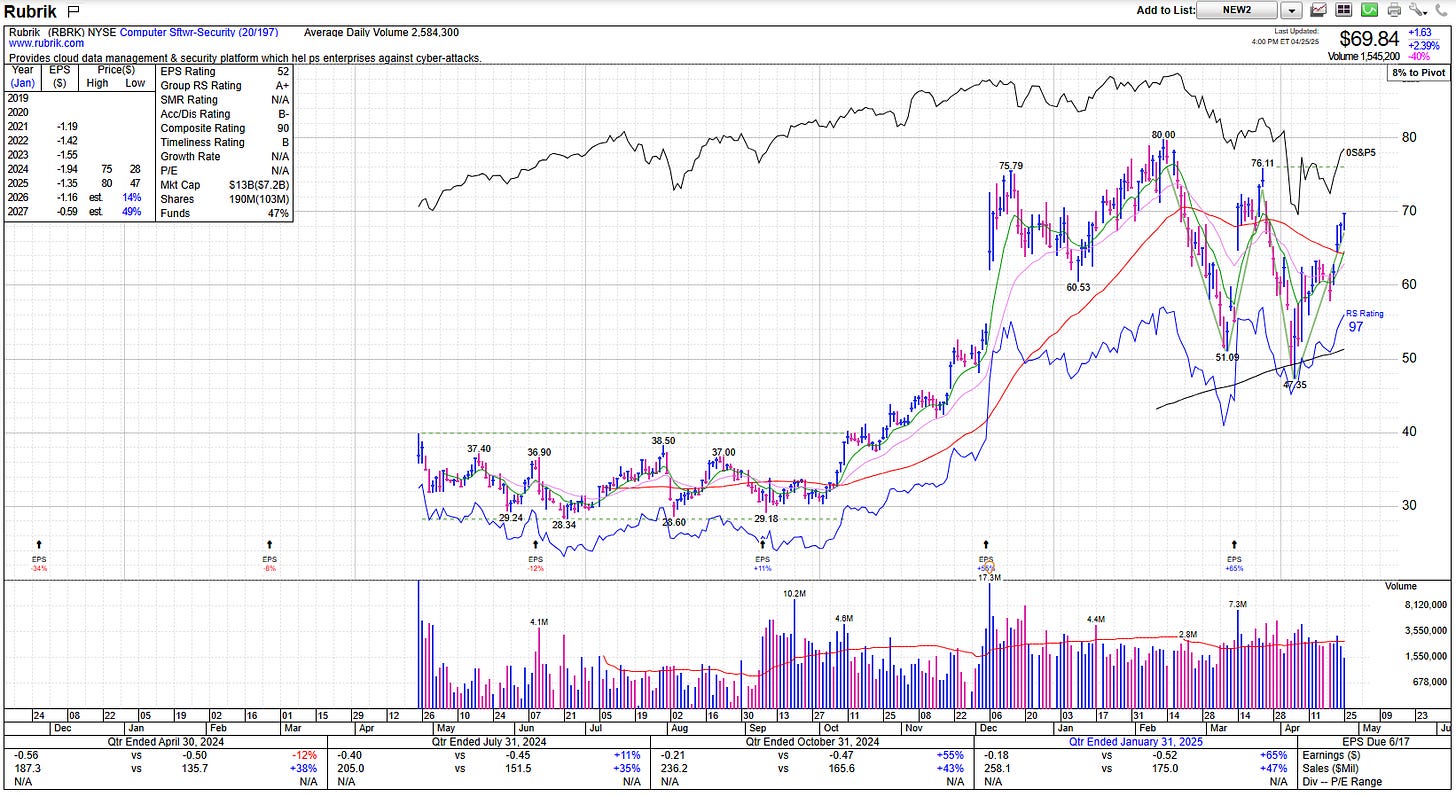

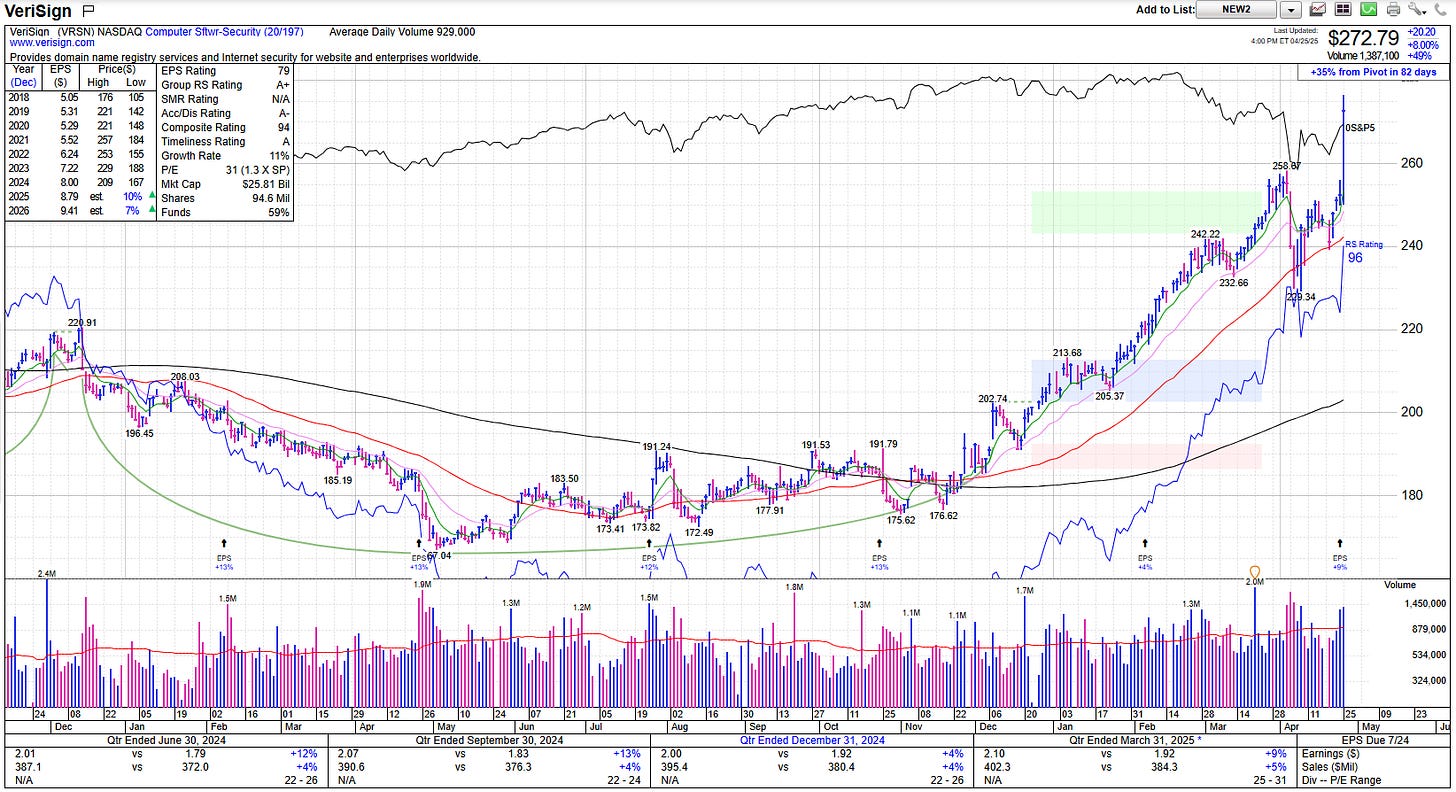

DUOL GEV HOOD RBLX RBRK VRSN

Thanks for reading TF Weekly! Subscribe for free to receive new posts and support my work.