Welcome! If you like TraderFella’s Trade Ideas, please consider taking a few seconds to help make these articles possible by support my work which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

GENERAL MARKET UPDATE

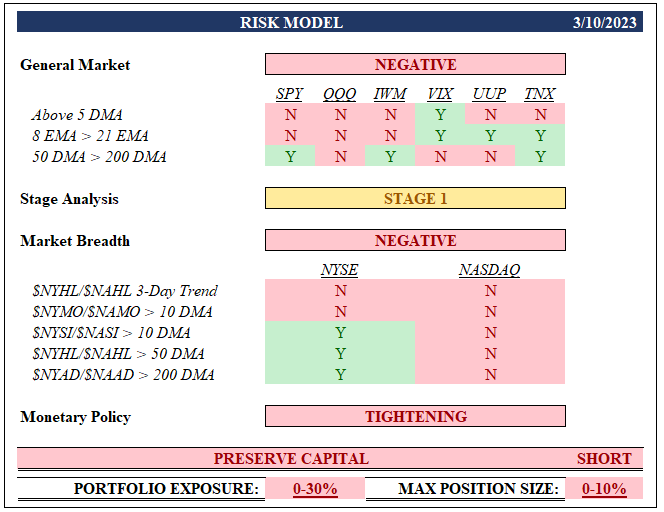

Coming into the week, I had a buy signal from my risk model after a 3 day strong rally coming off support on the major indexes, where we were starting to see some consecutive days of breadth on the NYSE and a number of quality setups emerging. On Monday, the indexes were propped up by an AAPL upgrade while IWM was in the red, which was telling for me of stalling action as I like to focus on IWM for clues of what’s going on under the hood with individual stocks. This moved my risk model to CAUTION and I sold more than half my positions that were forming gravestone dojis and looked like they were putting in short term reversals. On Tuesday, with follow through to the downside I closed my remaining positions and was completely in cash. I realized profits in all my positions and was very happy with how I was able to quickly get in and out by strictly following my risk model without personal bias. Although their was some setups coming into Wednesday, I was very skeptical and decided to sit on my hands and watch. I noticed that the indexes were being propped up by the semis, which many were pointing to as a sign to be bullish while breadth on the day was in the toilet. Turns out both the NYSE and NASDAQ had the highest net new low reading of 2023. So coming into Thursday I was actually pretty bearish and ended the day with 65% exposure short as I continued to gain traction on short positions throughout the day, first PINS (slicing through its 50 DMA), then DRIP (early morning reversal hammer candle), NVDA (breaking upward trendline) and SOXS (regaining its 5 DMA - semis looking toppy). Come to find out after the close the fiasco with SVB imploding. I was sure we would see a huge downside gap down on the heels of SVB contagion and most likely bad payroll and unemployment numbers. With hot numbers this morning, we had a decent decline initially but no follow through so I tightened my stops on my shorts and realized profits on a market bounce intraday ending the week completely in cash... WOW. What a shit show of a week which started out with a lot of promise. No need to go through any charts as clearly time is needed to sort out this mess and will first look for an early signs of a turning point in stocks from maintaining my risk model.

RISK MODEL

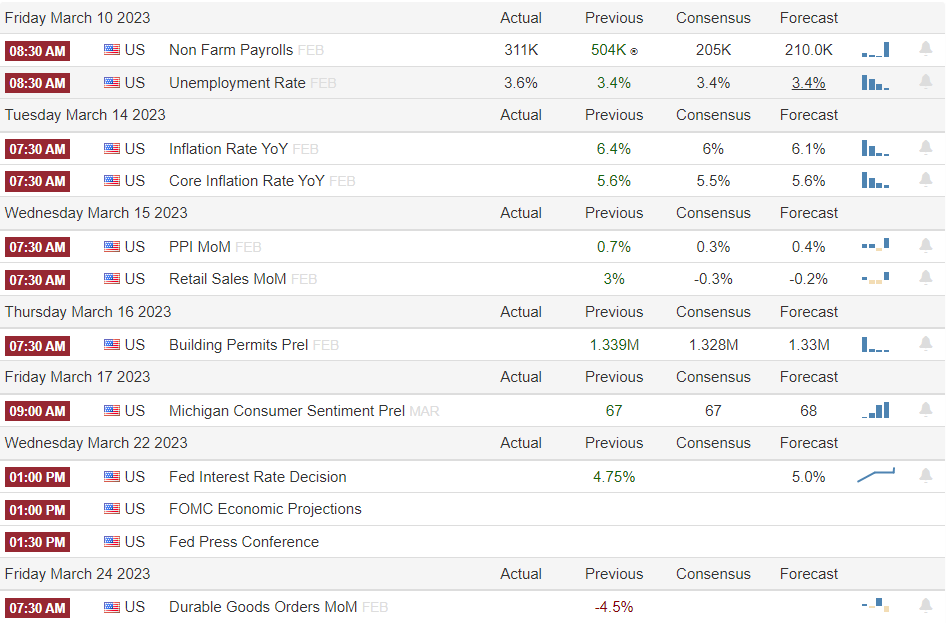

ECONOMIC CALANDER

GAME PLAN

This is a good time to do some house cleaning on watchlists. Anything not holding above its 50 DMA is going to my backup list and anything below its 200 DMA is pretty much off my watchlists. Only want to keep strong stocks on watch. Their are a handful of stocks that had strong earnings gap ups that are holding up very well above 8/21 EMAs so definitely something to focus on if we do get another rally.

With todays action not completely imploding like I initially thought, I’m keeping an open mind and will continue to track market breadth for clues. We’ll need to see breadth come back like we did in January for early signs of another meaningful rally. CPI and PPI this week should be interesting as potential catalysts with the Fed meeting the following week. Will be happy to be in cash through this volatility.

WATCHLIST

ABNB, AI, ALGM, ALGN, ANET, ATEC, AXON, AYX, BLDR, CRSR, CRUS, DHT, DKNG, DO, DUOL, ELF, FND, FOUR, FSLR, GFS, GLBE, GTLB, HIMS, HUBS, IOT, IRDM, MAXN, MBLY, MELI, NEWR, NRDS, ONON, PCOR, PERI, RBLX, SGML, SMCI, SPOT, SQ, SQSP, STLD, TENB, TGTX, TOST, UBER, VTYX, XM, ZETA