Welcome! If you like TraderFella’s Trade Ideas, please consider taking a few seconds to help make these articles possible by support my work which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

General Market Outlook

QQQ we had a 2 day pullback to the 8 EMA and reversed higher after a choppy session on the heels of Powell’s comments into near term resistance at the COVID low AVWAP (key area to watch tomorrow). Net new highs (bottom panel) and breadth remain positive.

UUP has met resistance at the AVWAP low from 11/15/22 where it last met resistance and reversed course on 1/6/23, which is bullish for stocks.

TNX 10 YR bounced off support at the 200 DMA and the bottom of the wedge trendline and is approaching the top of the falling wedge pattern. This is a bit concerning and something to keep an eye on that could thwart another rally. Hopefully we see a reversal foreshadowed by UUP.

Long-term outlook: The market is giving us bullish signals and constructive pullbacks in leading names should be bought. Patience is required for proper low risk setups or additional buy points to emerge either on pullbacks or on strength.

Short-term outlook: Setups in leading names are emerging, but keep an eye on TNX and UUP as upcoming economic data and earnings can lead to volatile swings. Ensuring low risk entries from sound technical setups is critical to not get shaken out of new positions.

Trade Ideas

Technology

GTLB

Bounced off 8/11/22 AVWAP high, 21 EMA, 200 DMA and closed above the 8 EMA. Looks ready to rested the IPO AVWAP where it last reversed course.

IOT

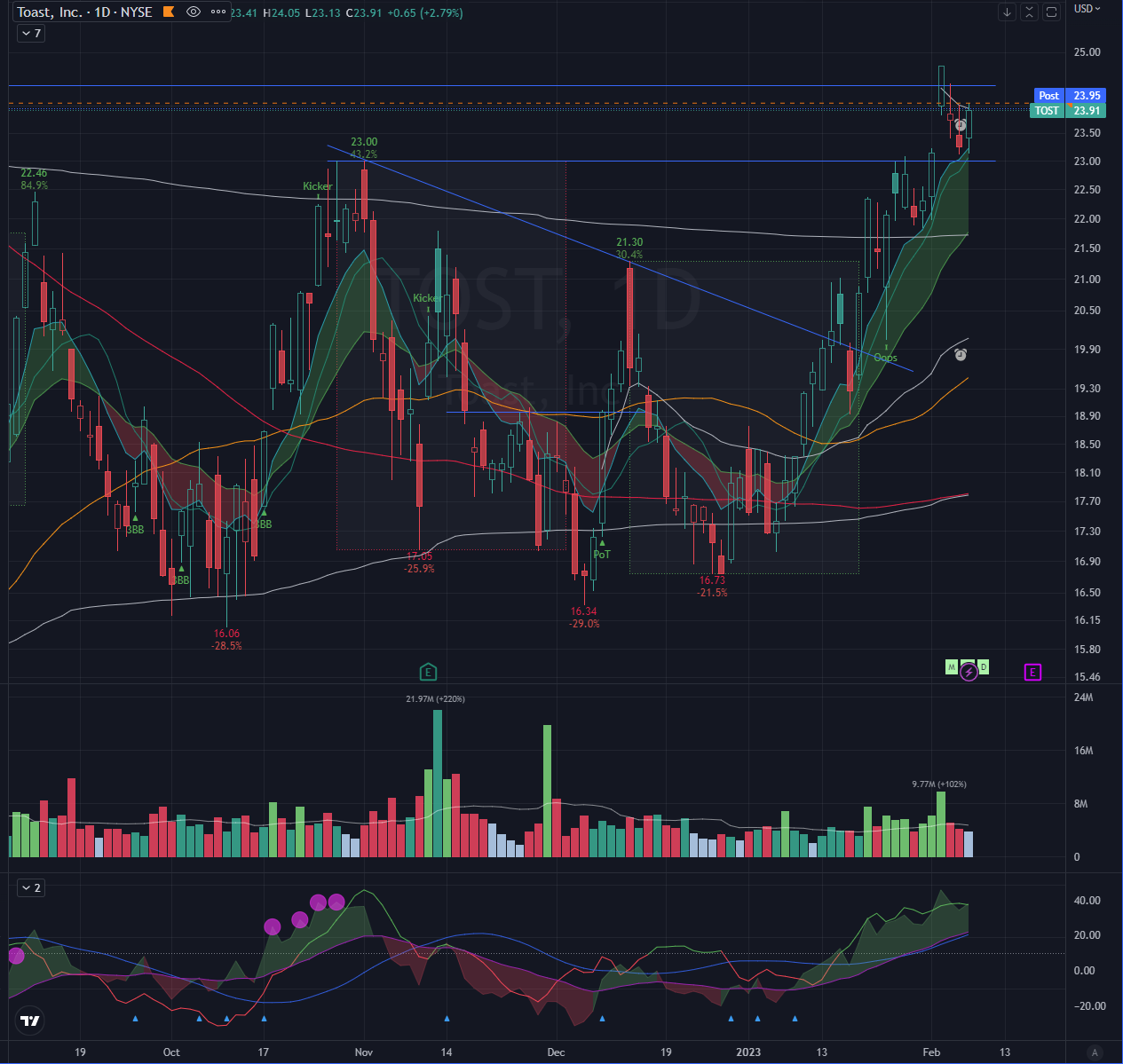

TOST

NTNX

Held 50 DMA and 21 EMA

BAND

AEHR

FOUR

Biotech/Healthcare

BHVN

21 EMA pullback

COGT

KYMR

ALT

Holding this downtrend line will look for a bounce off of it.

Earnings Gap Ups Tomorrow

TENB

NEWR

Post-market price is currently at ~$75 above the chart.

Solar

ENPH reported strong earnings beat after the close today and is set to gap up tomorrow morning. This will setup other solar names for potential moves, which have recently been weak. The solar names I’ll be watching are FSLR ARRY SHLS CISQ

Other

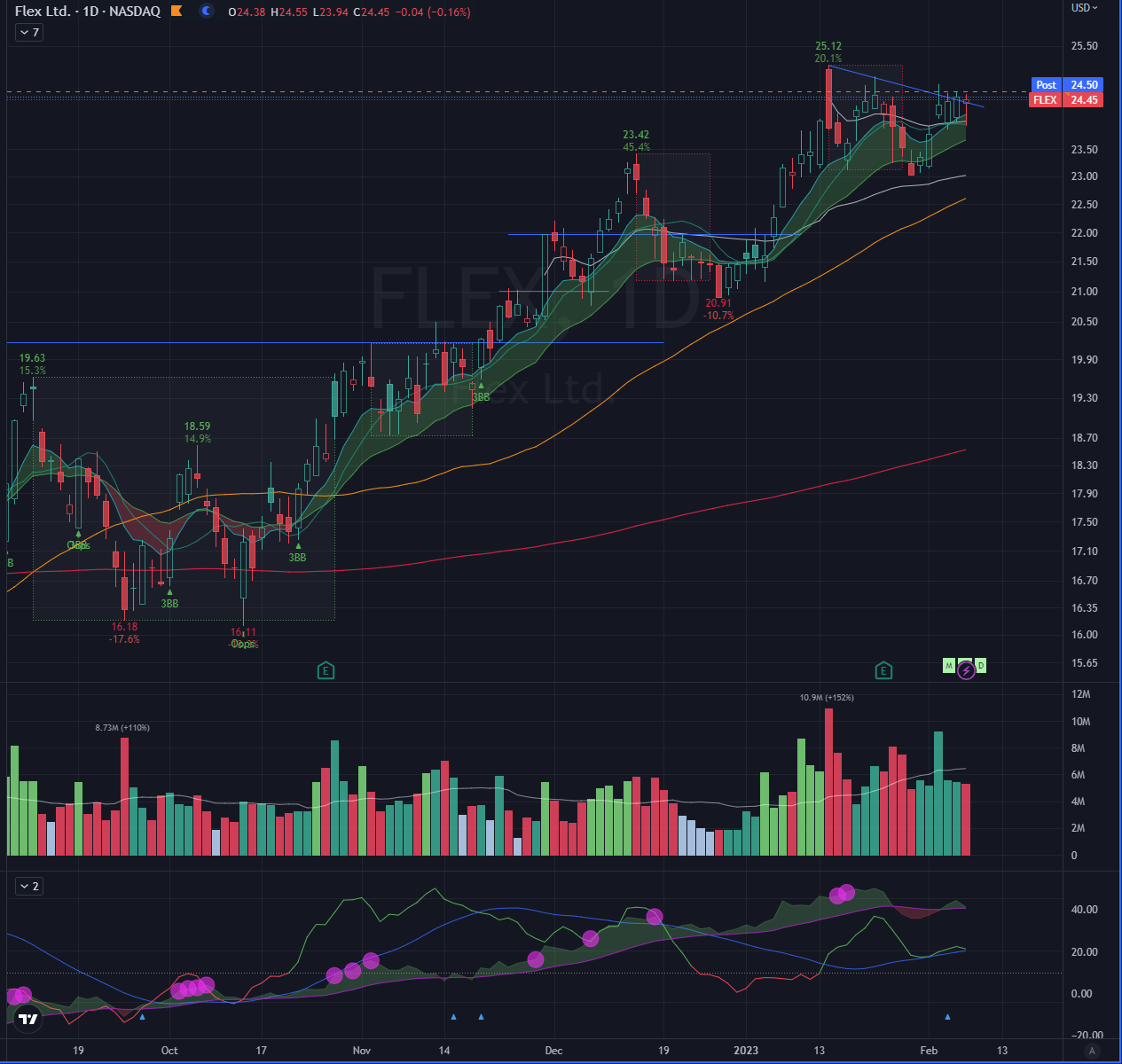

FLEX

Slower mover but setting up nicely.

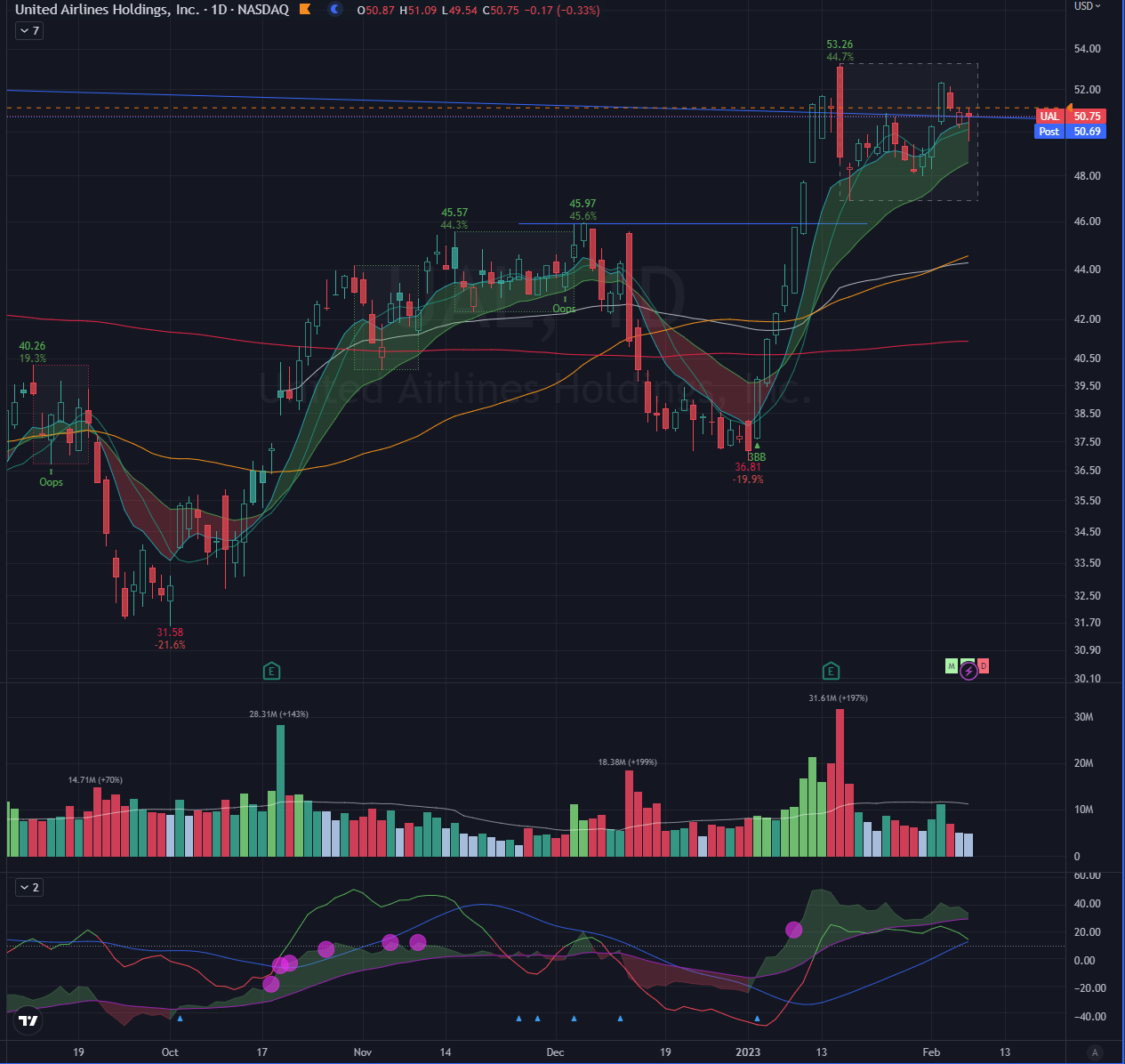

UAL

Another slower mover but potential leader in airline industry that has shown recent strength.

LABU

3x leveraged ETF - another way to play the biotech industry without single company risk.

NAIL

3x leveraged homebuilders ETF - another way to play this sector as most individual names are slower movers.