Welcome! If you like TraderFella’s Trade Ideas, please consider taking a few seconds to help make these articles possible by support my work which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

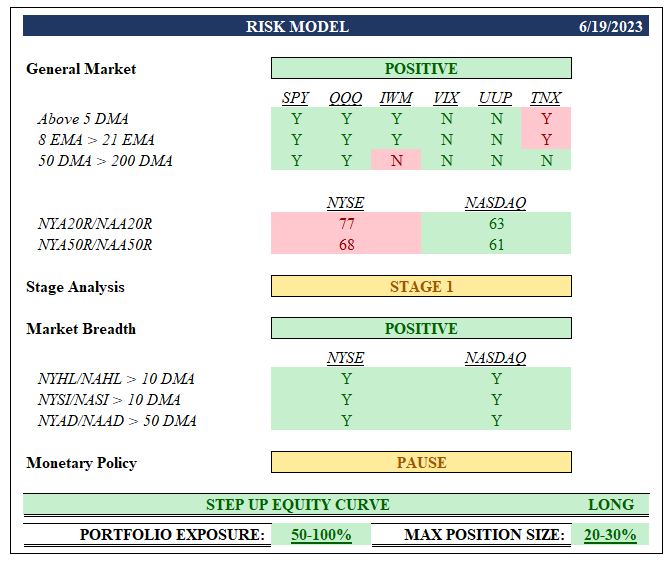

RISK MODEL & GENERAL MARKET

For the first time since early March when SVB imploded, I got a Buy Signal from my risk model on the first week of June as breadth finally improved. Up until this point I was in cash/MMF. I added small exposure leading up to the fed meeting last week. With the fed decision to pause rate hikes and a positive market reaction, I stepped up exposure last week as I’ve been gaining traction in new buys (for now). There are also a number of quality stocks setting up. We could be short term extended given the % of stocks above their 20 and 50 day moving averages; however, if this is the start of a new bull market this could remain elevated for some time. Currently, both QQQ and SPY echo this as they do look to be short term extended. Ideally we see a digestion of these gains and potentially a rotation from the mega caps to small/mid caps. A more broad based rally would be a healthy sign that money managers appetite for risk has increased. As an example of the moves the mega caps have made thus far, look no further than FNGU (3x leveraged FANG+ ETF concentrated in 10 mega cap names), which has a staggering YTD performance of 327%.

IWM

If a rotation to small/mid caps does play out, IWM looks to have plenty of room to run to the upside. We will want to see continuation on the break of this weekly down trend line, which its currently holding. On the daily we will also want to see if it can breakout of this coil and get above this band of resistance ($188 - $185) and above the all time high AVWAP, which are currently acting as resistance. If we’re able to clear, watch the ~$200 level as the next area of potential resistance.

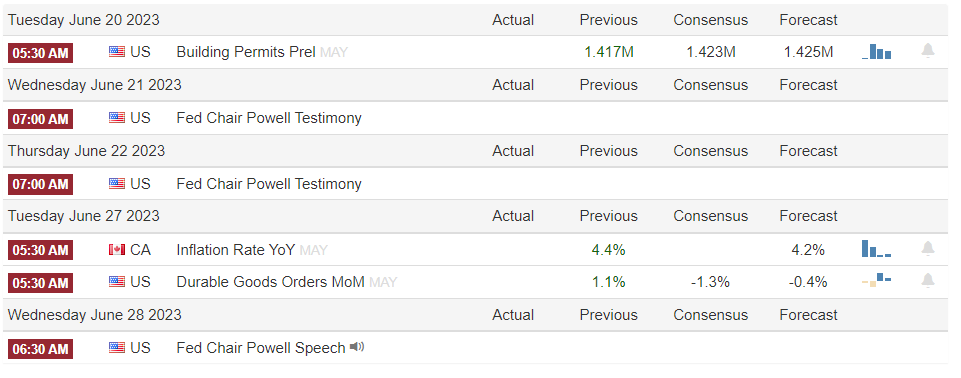

ECONOMIC CALANDER

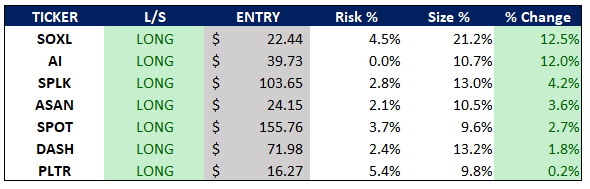

GAME PLAN

Given my current exposure, I will look to manage risk, especially with the volatility that will likely be caused by Powell’s testimony this week. I’ll only add exposure on picture perfect breakouts if things are working. My goal is not to add any more exposure unless I’m forced to by the action in stocks. There is a potential for a general market pullback, so I’ll be prepared to reduce exposure if necessary.

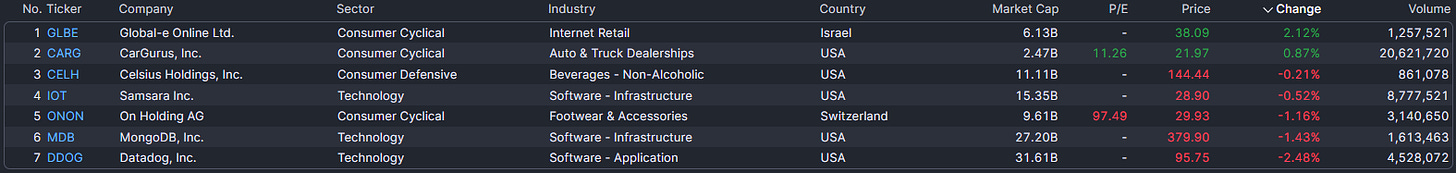

FOCUS LIST

GLBE

Newer issuer with a beautiful looking base with several days of tight closing ranges as it drifts back to the 8 EMA and holds the IPO AVWAP and the ~$37 level. Watching to see if it can breakout on volume.

CARG

Had an earnings gap up on May 10th and hasn’t looked back. LOOK. AT. THAT. VOLUME. Highest volume ever printed on Friday (20.5M shares)… also on the day before a long weekend where we typically see lower average volume across the board. Institutions are clearly showing us their cards here. It’s drifting nicely and orderly back to its 8 EMA, where it could set up a pullback buy.

CELH

One of the few stocks working last year is back into new all time highs. It had an earnings gap up on May 10th above resistance and hasn’t looked back. It drifted back to the 8 EMA on low volume and is now coiling. Watching for a breakout on volume. It also displayed David Ryan’s MVP criteria (green ants) as clear sign of institutional accumulation.

IOT

Had an earnings gap up on June 2nd and blasted off. Was rejected at ~$31 and has now pulled back to the 8 EMA for the first time since gapping up. Watching for signs of strength with a potential bounce off the 8 EMA/$29 level. If it comes in further, will watch the AVWAP from the earnings gap up and 21 EMA as next potential areas of support.

ONON

The $30 level from the IPO lows is a big area of potential resistance with the earnings gap up AVWAP from March 21st and 8/21 EMA as additional potential areas of support below. It’s also starting to flag on low volume under the 50 DMA. Watching for a breakout on volume through the 50 DMA.

MDB

Big earnings gap up that has been digesting the move with tight closing ranges over the past 2 weeks on low volume, allowing its moving averages to catch up. Also holding ~$390 level, which is a big level and potential area of support going back to its 2020-2021 base. Watching for a breakout on volume out of this trading range.

DDOG

Davig Ryan’s MVP criteria following earnings and ripping off the bottom. Has now met resistance at its all time high AVWAP above, but is now flagging and getting pinched by its IPO AVWAP. Looking for it to breakout of this flag on volume and through the all time high AVWAP. If it can clear, $115 level could act as next level of potential resistance from its 2020-2021 base.

PORTFOLIO

MAIN WATCHLIST

GLBE, CARG, CELH, IOT, ONON, MDB, DDOG, SYM, APP, STNE, PANW, ABNB, EXTR, DV, AXSM, UBER, EXAS, APLS, ANF, ITCI, DXCM, FND, ACVA, ELF, TTD, ACLS, DKNG, BLDR, ACCD, LEGN, LZ, DUOL, TGTX, PATH, ANET, SNOW, NET, URBN, YEXT, DOCN, SMCI, TOST, SQSP, CFLT, HUBS, PCOR, SHOP, MNDY, DT, SOFI, AZEK