Welcome! If you like TraderFella’s Trade Ideas, please consider taking a few seconds to help make these articles possible by support my work which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

GENERAL MARKET OUTLOOK

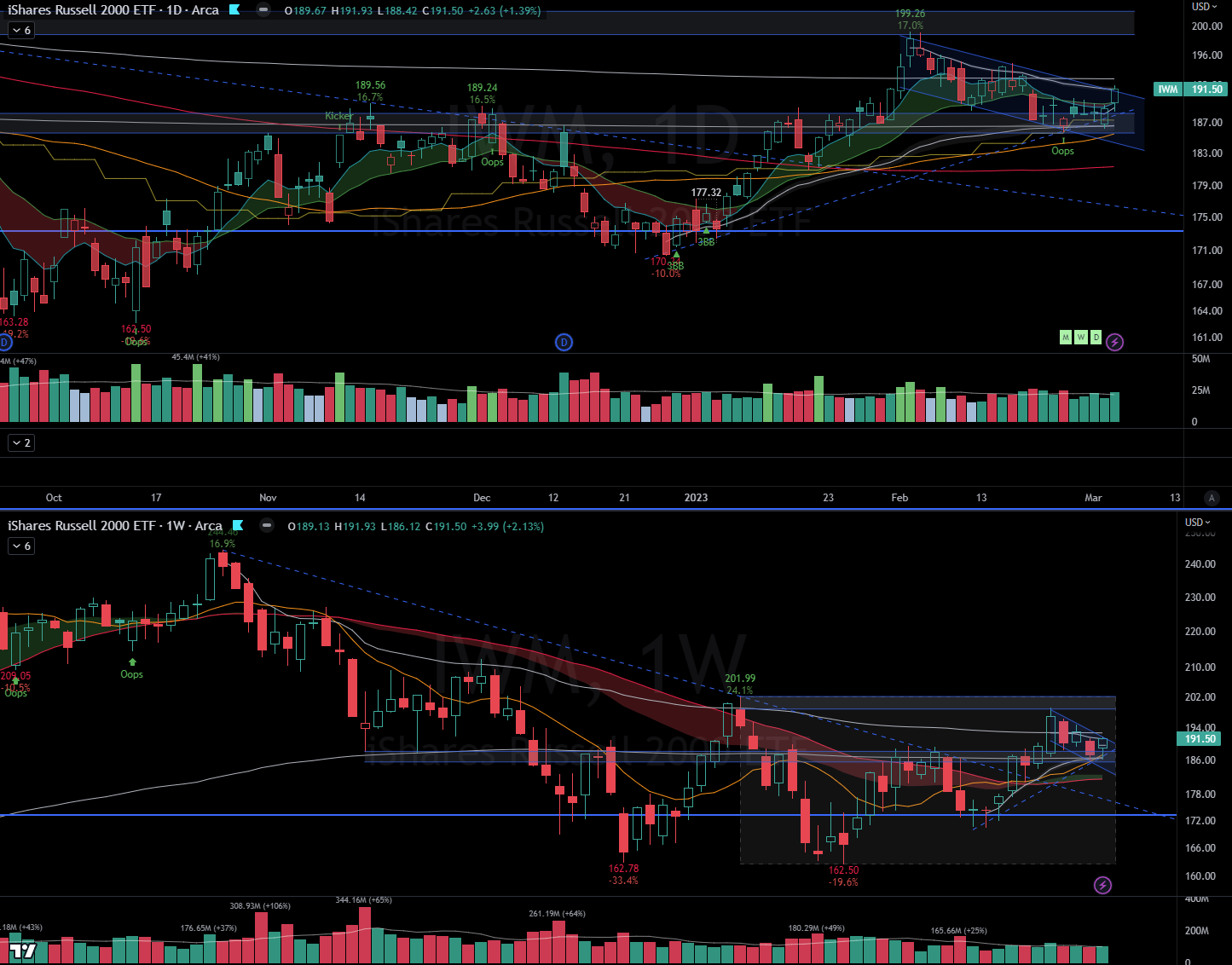

Risk on? Taking a deeper look at IWM, it was the first index to roll over in early November 2021, almost a month before the top in QQQ in late November 2021 and two months before the top in SPY in early January 2022. This was a clear warning sign for those paying attention of what turned out to be a nasty bear market. After what appears to be a bottom in all indexes in early October, IWM had a golden cross in early January 2023, a week before SPY and QQQ looks like it will be crossing this week. During this recent market pullback, IWM held up much better technically then its peers QQQ and SPY by trading well above its down trend line from the 2021 peak and finding support at its 10 week line (yellow stair stepper on the daily chart above), while both QQQ and SPY retested their respective 200 DMAs.

As what seemed to be a scary market pullback at the time, now looks to be constructive flagging action with a cup and handle pattern forming in IWM. This is also echoed by looking at individual stocks as their are a number of similar setups emerging. Going forward, I think IWM will be a good indicator for what’s happening “under the hood” with individual stocks (as true market leading stocks bottom and breakout well before the indexes) and that we should be paying closer attention to small/mid cap names rather than the mega caps of old. IWM is telling me… RISK ON!

DXY

The dollar has been trading in this descending channel since the peak in September 2022 and is now right up against the downward trendline, that has acted as resistance thus far.

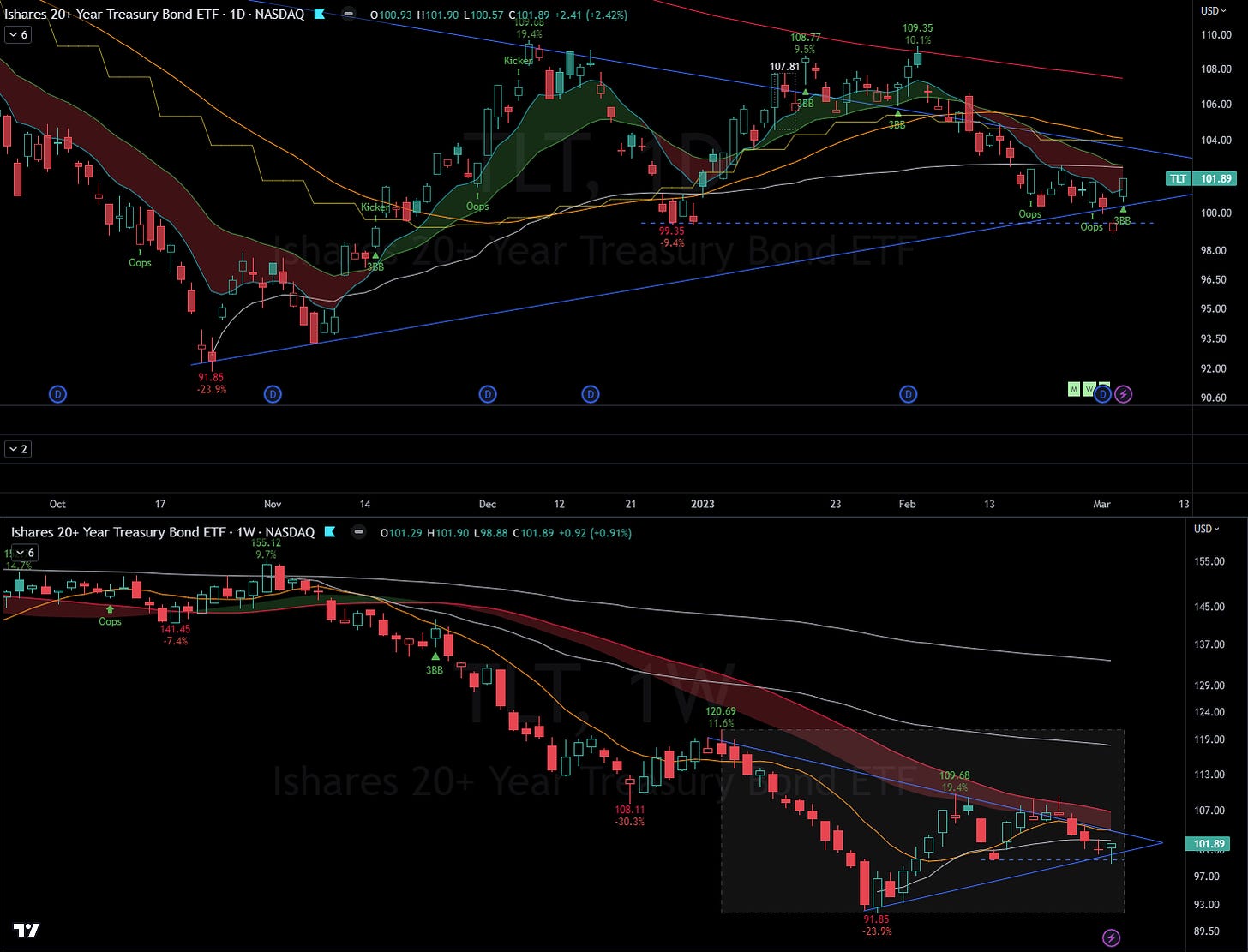

TLT

TLT gapped lower on Thursday, which looked to be ominous and may have forced many bulls to capitulate (SPY and QQQ undercutting the 200 DMA). Bears that came in late also got caught with their pants down on Friday’s gap up, proving Thursdays action to be a false breakout. Reminder to be cautious of obvious moves and that the market wants to inflict max pain on both sides before resolving. Looking at the weekly, it has held the downtrend line of this symmetrical triangle with a convincing hammer candle on the weekly. Will look for continuation of the reversal. A breakout to the upside would be bullish for equities.

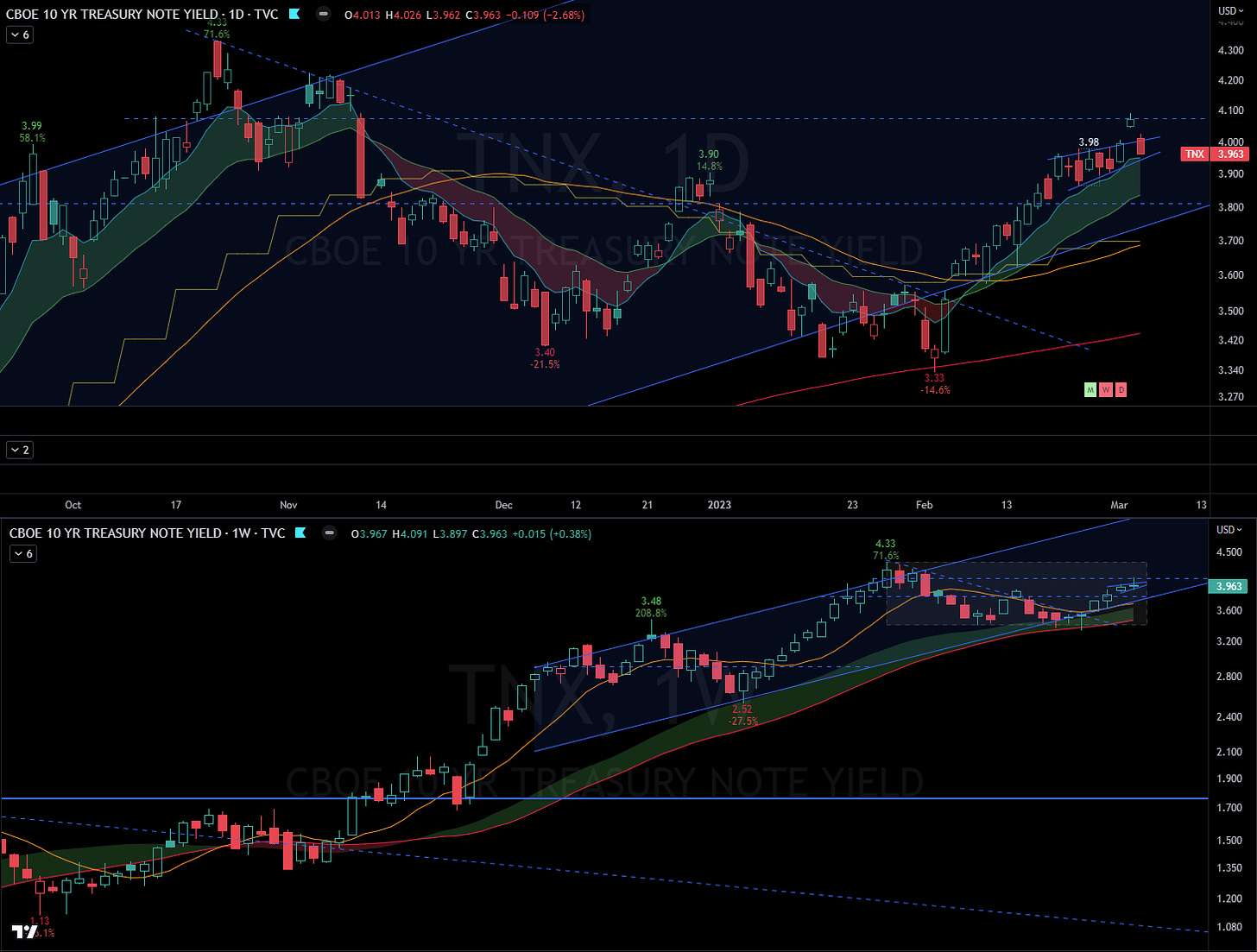

TNX

TNX has been trading in this ascending channel since breaking out of its base in January 2022 (coincided with the peak in SPY). It looks to have found resistance near the October 2022 highs and has gapped back down into a mini bearish rising wedge pattern, while also putting in a gravestone doji candle on the weekly. If yields can reverse course, this would also be bullish for equities, but their is plenty of potential support below so something to keep an eye on.

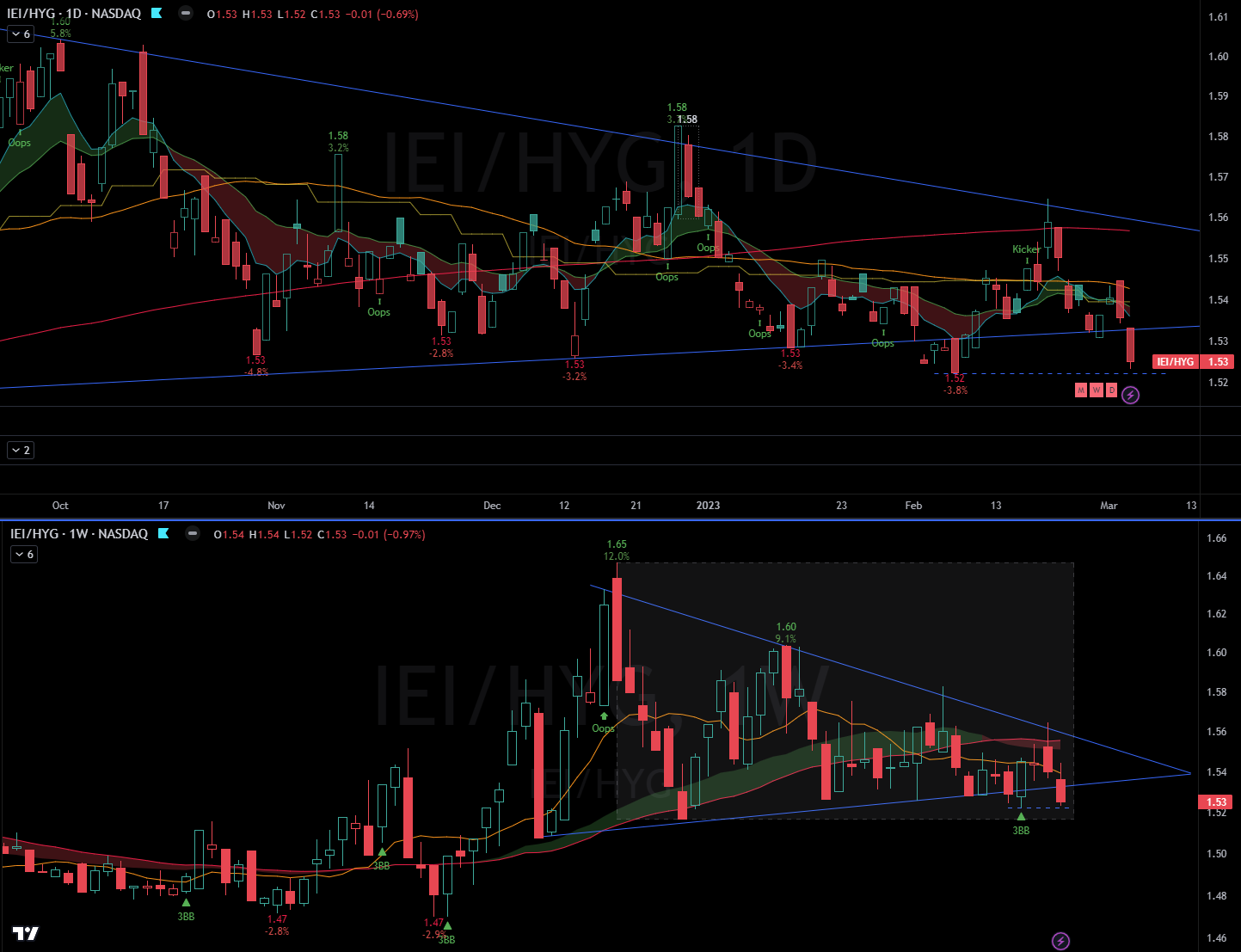

IEI/HYG

IEI/HYD credit spreads look to be breaking out to the downside as it takes out the upward trendline, which is also bullish for equities. Watching for follow through.

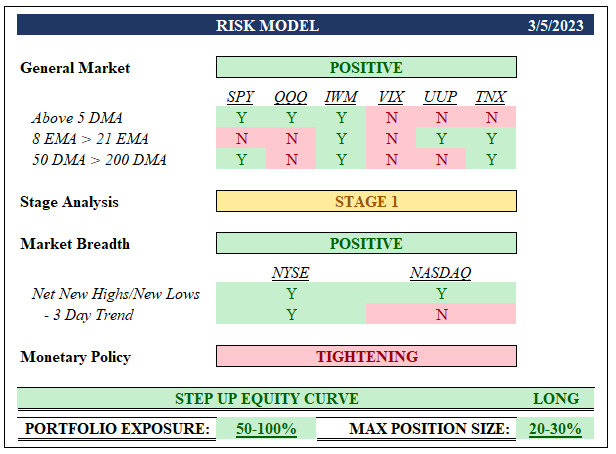

RISK MODEL

ECONOMIC CALANDER

TUE/WED 10 AM EST - Powell speaking

WED 8:30 AM - JOLTS

FRIDAY 8:30 AM - NFP

GAME PLAN

Based on my risk model, we have the first buy signal after the close on Friday since the markets previous rally. Breadth on the NYSE has improved posting net new highs for the 5th consecutive day with the NASDAQ joining the party on Friday. SPY QQQ and IWM have regained their respective 5 DMAs while IWM has also had its 8 EMA cross over its 21 EMA with QQQ to follow shortly, signaling a short term uptrend. Its also important to note that Friday was the first time QQQ and SPY closed above their respective 5 DMAs since February 15th, when the market pullback began to materialize. VIX 8 EMA has crossed over the 21 EMA, losing its short term uptrend, and UUP and TNX losing their respective 5 DMAs. Therefore, market internals are telling us to add exposure and we’d best ignore any outside noise vs. what the market is clearly telling us.

This week I will look to manage open positions in the face of potential news driven volatility (see economic calendar above) and focus on adding more exposure in names breaking out of constructive setups. Something important to note is that although their are many bases to choose from setting up, I think its important to be mindful of overhead supply. Names trading near or above their 2021 AVWAP highs or IPO AVWAP will fair better in my opinion than other names working through significant overhead supply. For example FSLY, it may be building the left side of a base here (not a proper base yet) and its AVWAP from the 2021 high is near ~$51 but is currently trading at ~$14. This previous big winner had an ~88% haircut from its 2021 highs and most buyers are severely underwater. Sure it had a 10% move on Friday, but this stock in my opinion is going to really struggle and likely be a laggard compared to other names breaking out of properly built bases with little to no overhead supply. Overhead supply can be tricky because bag holders will be happy to sell at breakeven a year later which is likely much higher than its current stock price is now. I will also be watching closely for any change in market internals and have no problem taking profits/closing positions and going back to cash quickly if general market and breadth deteriorate.

FOCUS LIST

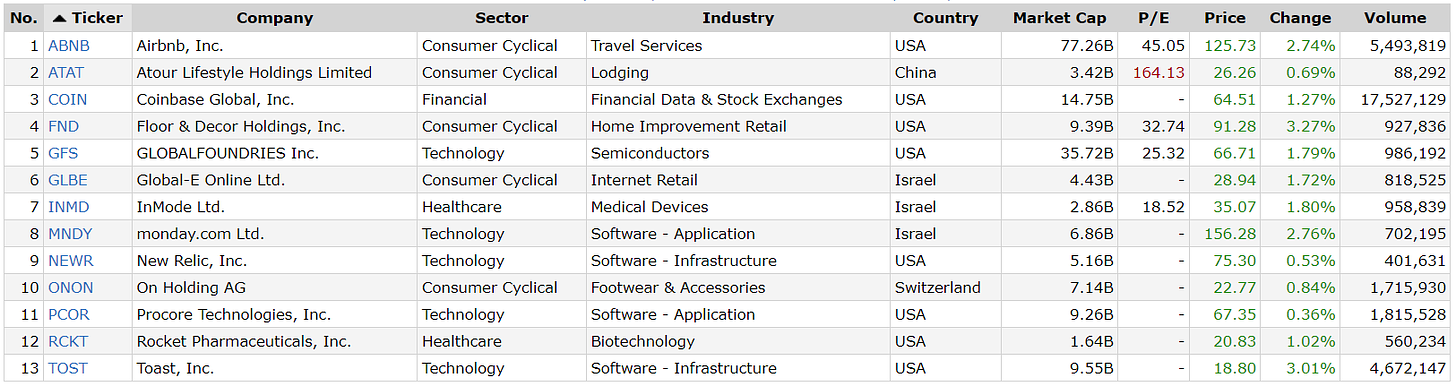

ABNB

Idea: Long

Pattern: Double Bottom

Entry: Flag breakout

Notes: Want to see convincing breakout through near term resistance on volume.

ATAT

Idea: Long

Pattern: Ascending Base/Channel

Entry: 3 consecutive tight closes holding support w/ doji candle

Notes: Want to see takeout the previous high of the previous 2 days on volume

COIN

Idea: Neutral

Pattern: Asymmetrical Triangle

Entry: Breakout above or below triangle

Notes: Could breakout above AVWAP from recent swing high or down through the upward trendline. With recent weakness in crypto and potentially looming bankruptcies such as SI Silvergate and Binance looking to repeat FTX collapse, this could be a good short idea. On the other hand, COIN is the only publicly regulated exchange and with its recent acquisition on Friday of One River Digital Asset Management it can continue to gobble up market share. Either way, will look for price to confirm direction. Also important to note COIN is heavily shorted (~19% of float). I’ve loved trading COIN so far and has been my biggest winner long & short this year.

FND

Idea: Long

Pattern: Cup and Handle

Entry: Flag/Handle Breakout

Notes: With BLDR already breaking out… its likely the leader of the group, but also evidence that these names are working. Very nice constructive base and trading above its AVWAP high from 2021.

GFS

Idea: Long

Pattern: Ascending Triangle

Entry: 3 touch trendline/AVWAP from recent swing high

Notes: Semis have been hot and this younger issuer looks promising. I’ve tried it a few times, but has lacked follow through volume. Looking for big volume change of character on a breakout.

GLBE

Idea: Long

Pattern: Cup and Handle

Entry: Flag/Handle Breakout

Notes: Similarly to GFS, I’ve tried this one a few times but has lacked volume, which is what I’m waiting for. Handle is also a bit deeper in the base then I would like but keeping on watch to see if it works.

INMD

Idea: Long

Pattern: Ascending Triangle

Entry: Confirmation of Reversal/bounce off support through KMAs

Notes: Somewhat of a pullback buy setup off the upward trendline but could get a low risk entry on a small starter position here.

MNDY

Idea: Long

Pattern: Saucer Base

Entry: Breakout above IPO low trendline

Notes: Either this is a saucer base or it needs to put in a handle. A little deep for a saucer base so cautiously optimistic. New issuer with a nice fundamentals. I want to see massive volume bar on the breakout. Feels like it could be a monster.

NEWR

Idea: Long

Pattern: Cup and Handle

Entry: Breakout above trendline

Notes: Need to see follow through volume. Nice digestion after gap up on earnings.

ONON

Idea: Long

Pattern: Cup and Handle

Entry: 3 Touch trendline

Notes: Bough on flag breakout and sold for a small gain on Fridays doji close at the 3 touch trendline. Need to see follow through volume. Still has to report earnings in 2 weeks so will need to build a cushion prior. Could retest the flag trendline below before breaking out through the 3 touch trendline.

PCOR

Idea: Long

Pattern: Cup and …Handle?

Entry: Flag Breakout

Notes: Nice basing formation and newer issuer trading above AVWAP from IPO. Not sure if it still needs to put in a proper handle but has been flagging on the top of the base.

RCKT

Idea: Long

Pattern: Ascending Triangle

Entry: Coil/Inside Day/3 Touch Trendline

Notes: Biotech but love the coiling and bounce off the upward trendline after earnings. Battling AVWAP from 2021 high above but if it can breakout should have room to run.

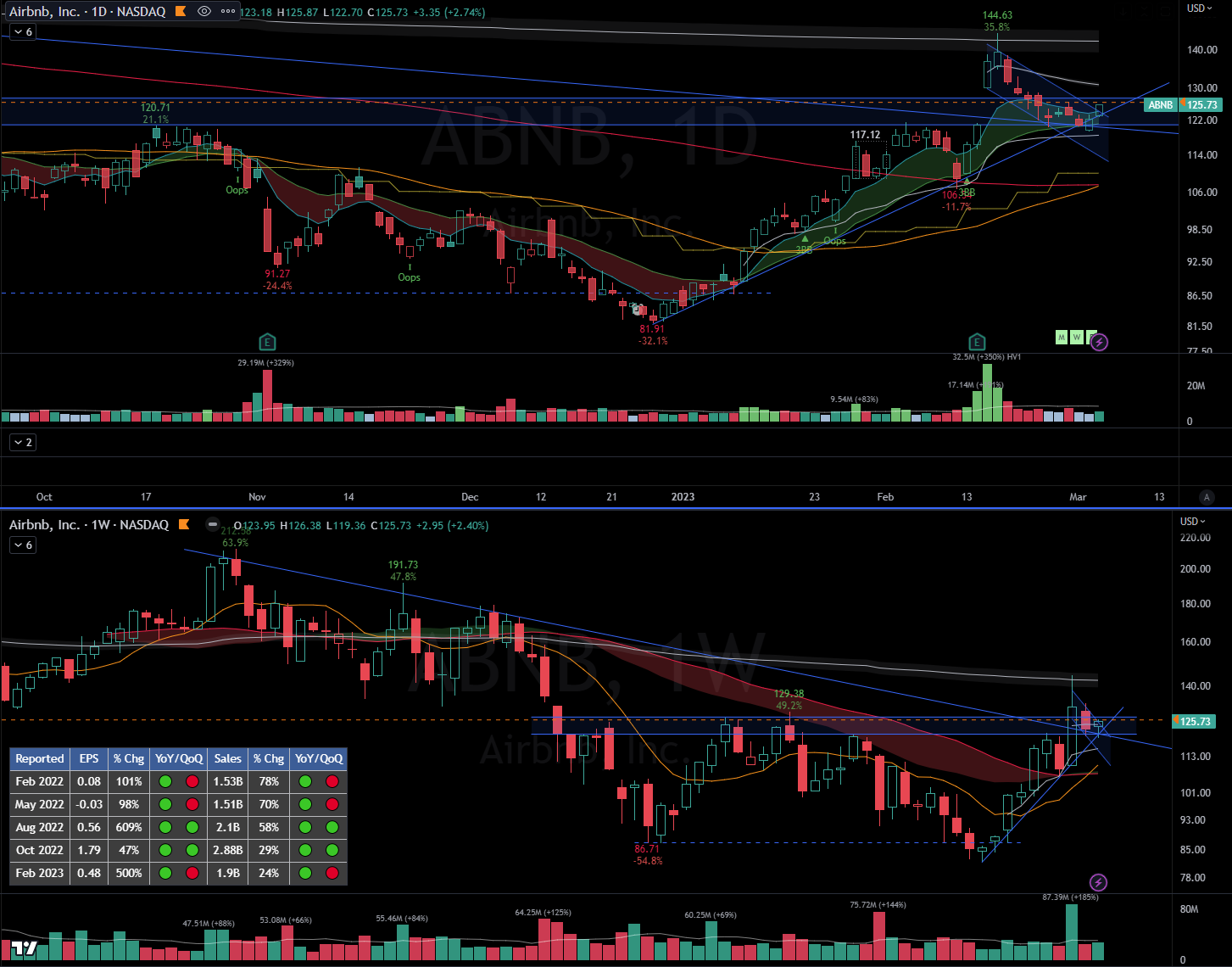

TOST

Idea: Long

Pattern: Ascending Triangle

Entry: Reversal off trendlines/ 200 DMA

Notes: Market didn’t like earnings, but their POS systems are EVERYWHERE. Anytime I go out to eat at a restaurant they are always using TOST. New issuer also battling with its IPO AVWAP. I like the story so wouldn’t mind trying to work my way into a low risk starter position here.

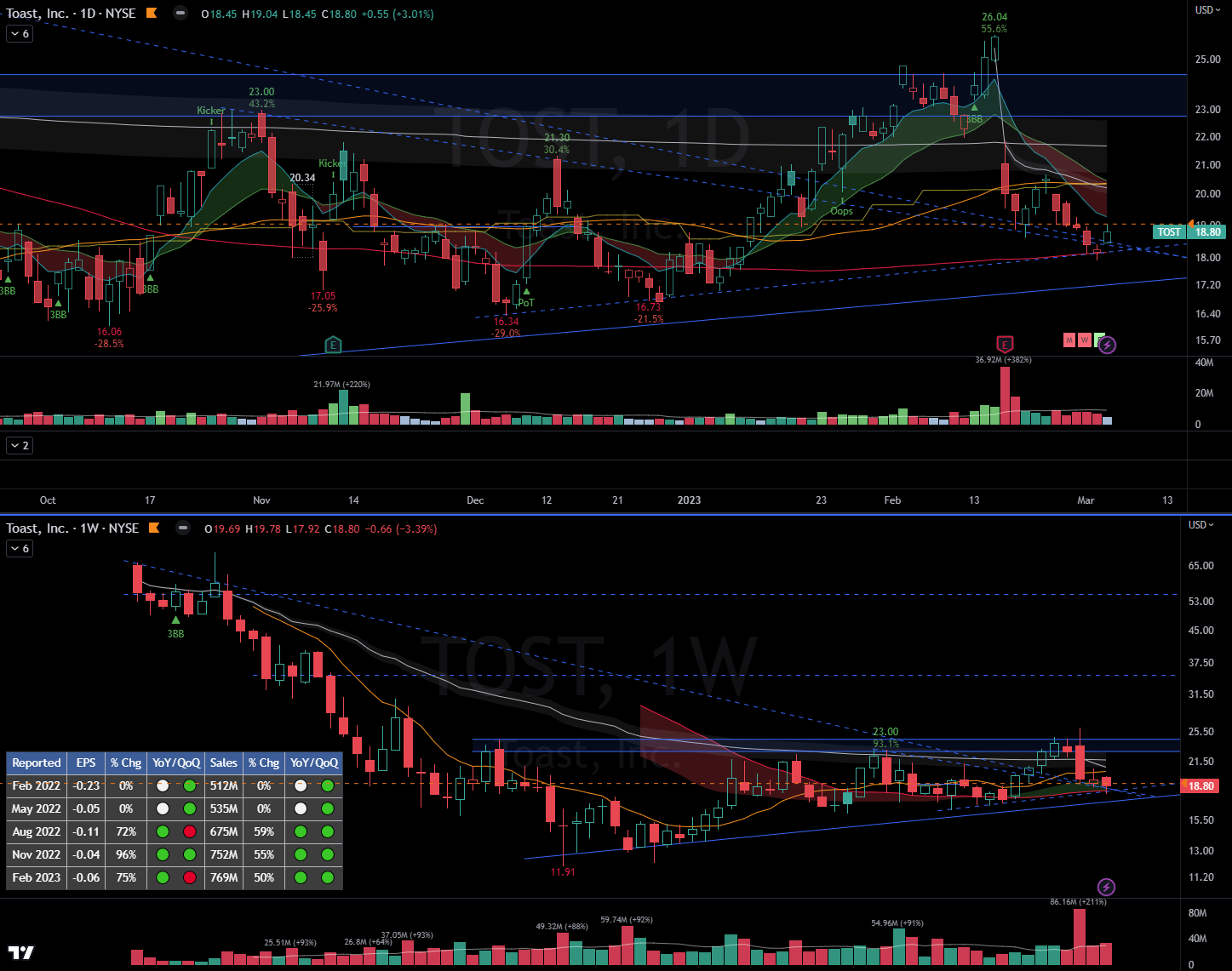

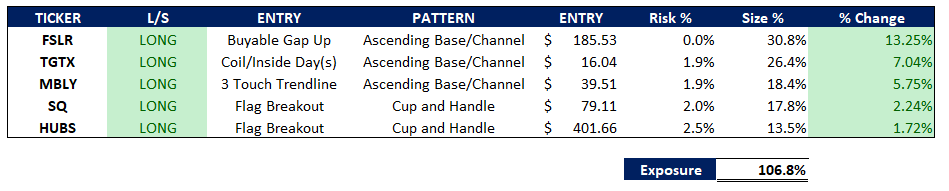

PORTFOLIO

MAIN WATCHLIST

ADNT, AI, ALGM, ALGN, ANET, ASO, ATEC, ATI, AXON, AYX, BE, BLDR, CDAY, COGT, CROX, CRUS, DHT, DO, DUOL, ELF, ETNB, ETSY, FOUR, HIMS, INSW, IOT, IRDM, LTH, MELI, NVDA, PD, PERI, PINS, RVNC, SANM, SGML, SHAK, SMAR, SMCI, SPOT, SQSP, STLD, TENB, UBER, VRT, VTYX, XM, ZETA