Welcome! If you like TraderFella’s Trade Ideas, please consider taking a few seconds to help make these articles possible by support my work which is always very much appreciated!

Subscribe for future newsletter.

Leave a like or comment on this post.

Share this post on Twitter.

GENERAL MARKET OUTLOOK

NVDA’s well received earnings report discussing AI coupled with hot economic data caused a gap up and then a quick fade only to end the day in a round trip into slightly positive territory. SPY held its upward trendline and its 50 day moving average closing with a hammer candle on above average relative volume. Similar story for QQQ and IWM who posted hammer candles on above average volume holding key AVWAPS.

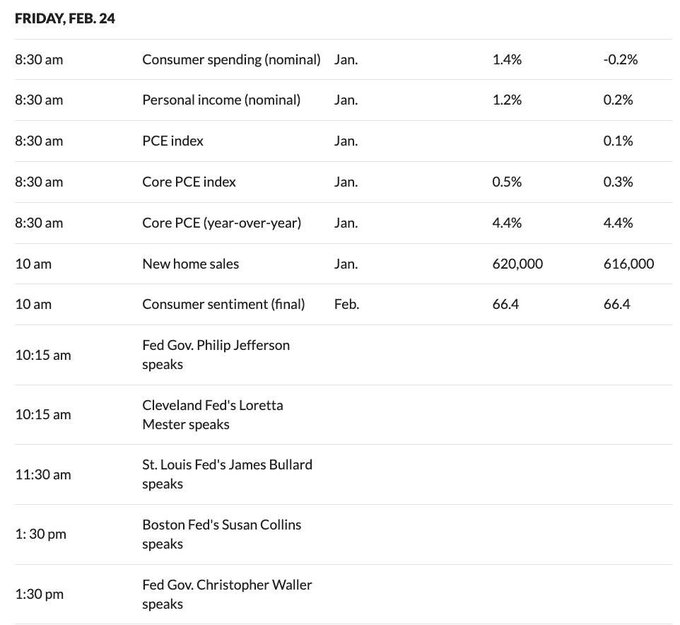

More of the same choppy action this week that is best to be avoided as the market looks for more clarity on the inflation picture from incoming economic data and how that will impact the feds decision making. As the indexes hold at key support levels we may get some clarity on the inflation picture with PCE data coming at 5:30 PST, which is the fed’s favorite indicator of inflation. Will this chop fest finally be over?

ECONOMIC CALANDER

RISK MODEL

GAME PLAN

Based on my risk model, we are currently in a preserve capital mode so sitting on hands an watching the action is likely on deck for tomorrow. I may also look to play the downside if setups intraday presents themselves using SQQQ or DRIP (3x inverse leveraged ETFs). So far the action has been choppy and a quick scalp environment.

However, based on how we respond to the economic data tomorrow morning and where the indexes have held up thus far, we could reclaim the 5 DMA on the major indexes, likely causing UUP to lose its respective 5 DMA, which would be positive for the general market. We would also need to see breadth pick back up as we are currently in a 3 day negative trend of net lows on the NASDAQ. *IF* we have this type of reaction to tomorrows news, this could move my risk model to a PILOT BUY environment where we could try some pullback setups with small position sizing. You never know what the market will do so you always have to be prepared for both sides of the trade especially as we are currently at an inflection point on the indexes holding key levels of support.

TRADE IDEAS

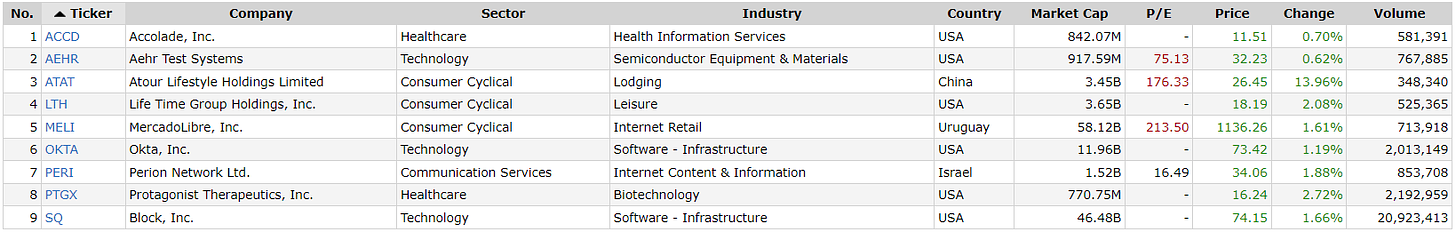

Watchlist

ACCD

Held its 21 EMA and looking to break this down trendline. Has displayed David Ryan’s MVP criteria (green ants).

AEHR

Would want to see volume come back in, but holding up nicely and looking to break this down trendline.

ATAT

IPO that can trade choppier, but nice above average relative volume today testing this down trendline. May have gotten ahead of itself, so a pullback to the 5 DMA/8 EMA/21 EMA would be welcomed and then break the down trendline.

LTH

Big volume bars holding up well looking to break this down trendline.

MELI

Potential earnings gap up.

OKTA

Hammer candle off the 50 DMA and looking to break the down trendline. Want to see a convincing breakout on volume through the down trendline and the 200 DMA.

PERI

Looking for continuation tomorrow.

PTGX

David Ryan’s MVP criteria (green ants) with a nice tight range holdings its 8 EMA. Look at that volume bar today.

SQ

Potential earnings gap up.